Global Game of Chicken

Expect it to remain this way until someone decides to de-escalate.

The US has decided to continue with the game of chicken with China, with the global economy at stake. The US now has 104% tariffs (some put it at higher effective tariffs) on Chinese goods and China will respond with a 34% tariff on US goods on 10 April if no one blinks by then.

The world is now caught in an escalating trade war that has caught many by surprise. How will this end? What was thought by most as a negotiating tactic has now devolved into a street brawl. It’s no surprise market volatility is extremely high with intraday swings that turn on a dime for no apparent reasons.

Expect it to remain this way until someone decides to de-escalate. Trump is claiming victory as many nations are “kissing his ass” to make a deal, but with the tariffs now in effect, export shipments will likely be delayed as businesses are unlikely to be able to afford the punitive tariffs. There is likely to be confusion and delays in shipments in the days ahead. That will not be good for market sentiment.

Tradertainment

AI-Powered Blood Tests: Detecting Cancer Before It Strikes

In 2024, scientists achieved a groundbreaking milestone in medical diagnostics: an AI-powered blood test capable of detecting over 50 types of cancer in their earliest stages. This revolutionary test, developed by researchers using advanced machine learning algorithms, analyzes tiny fragments of DNA shed by tumors into the bloodstream. By identifying unique genetic markers, the AI system can pinpoint the presence and type of cancer with remarkable accuracy—even before symptoms appear.

The implications of this technology are enormous. Early detection significantly improves survival rates, as treatments can be administered before the disease progresses. This innovation is particularly impactful for cancers that are notoriously difficult to diagnose early, such as pancreatic and ovarian cancers. Beyond diagnostics, the AI system is being adapted to monitor treatment responses and predict relapse risks, offering a comprehensive tool for personalized cancer care.

Day Ahead

United States – FOMC Meeting Minutes: Provides deeper insights into the Federal Reserve’s March policy discussions and outlook on inflation and growth.

Trading Plan

1. Currencies:

Neutral for now.

2. Commodities:

Gold - Gold remains a buy on dips.

Uranium & Energy - Stay invested for now.

3. Stocks:

US Stock Index: The US stock market resumed its fall as investors remained fearful ahead of the imposing of additional tariffs on China.

(For more timely info on our Trading plan, click HERE)

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks:. Will the punitive tariffs scheduled to become effective on 9 April be really implemented? That’s key for risk sentiment today.

What Happened Yesterday

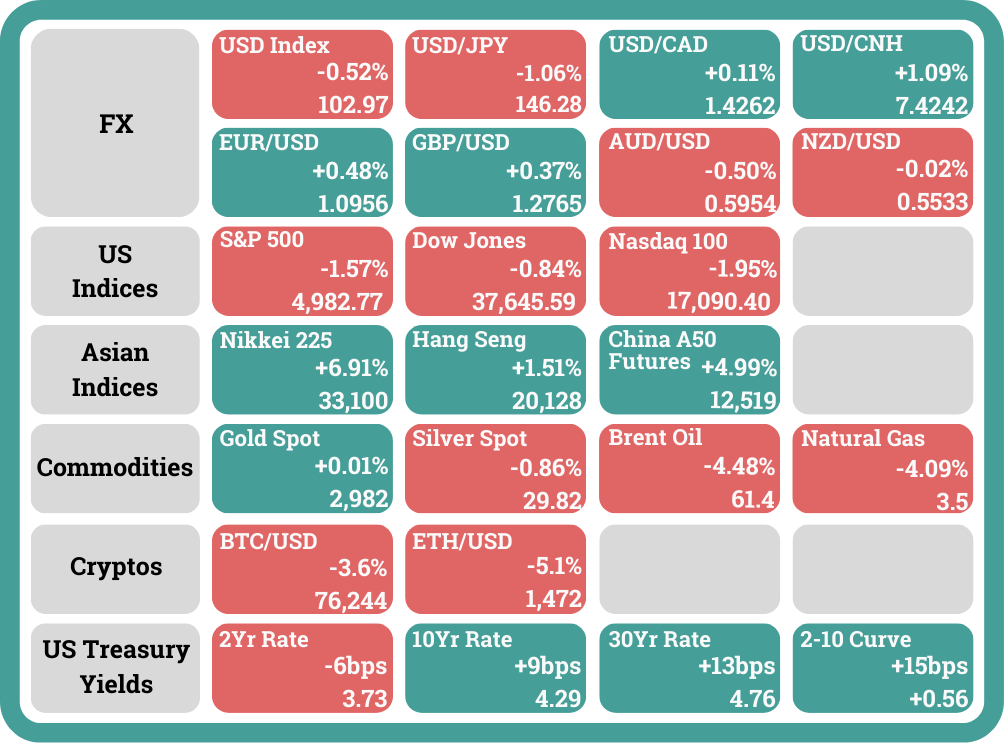

Market Movements as of New York Close 8 Apr 25

Economic Data:

New Zealand – RBNZ Interest Rate Decision: The RBNZ cut interest rates by -0.25% to 3.5% as expected because of the economic uncertainties due to the current trade war. In the words of RBNZ, “As the extent and effect of tariff policies become clearer, the committee has scope to lower the OCR further as appropriate. Future policy decisions will be determined by the outlook for inflationary pressure over the medium term.”. The NZDUSD rose +0.45% in immediate reaction.

U.S. Market:

The US stock market saw another fallout as Trump’s next tariff deadline that will see a cumulative tariff of 104% slapped on China draws near.

S&P 500: slipped -1.57% (intraday high: +4.05%, low: -3.00%)

Dow Jones Industrial: fell -0.84% (intraday high: +3.85%, low: -2.27%)

Nasdaq 100: sank -1.95%, (intraday high: +4.45%, low: -3.33%)

Global Markets:

Asia:

The Chinese market recovered over news that Beijing is planning to step up efforts to stabilise the Chinese stock markets (see headline 2). With state-owned fund, Huijin, having declared that it would increase share holdings and with the headline that “PBOC TO PROVIDE RE-LENDING SUPPORT FOR HUIJIN WHEN NEEDED”, it is a clear signal that the Chinese government is willing to strongly support the market and avoid a market crash in the days ahead.

Cryptocurrency Market:

The crypto market traded lower alongside the US stock market.

Foreign Exchange (FX) Market:

The JPY strengthened on the back of risk aversion while risk currencies such as the AUD and NZD fell.

Headlines & Market Impact

Treasury Secretary Bessent says China’s escalation was ‘big mistake,’ country playing with ‘losing hand’

Notable Snippet: Treasury Secretary Scott Bessent said Tuesday the U.S. holds a substantial advantage over China as the two nations exchange threats in a burgeoning trade war.

“I think it was a big mistake, this Chinese escalation, because they’re playing with a pair of twos,” Bessent said during an interview on CNBC’s “Squawk Box.” “What do we lose by the Chinese raising tariffs on us? We export one-fifth to them of what they export to us, so that is a losing hand for them.”

So far, he said Japan has been at the forefront of countries eager to negotiate, and the White House expects a multitude of others.

“I think you are going to see some very large countries with large trade deficits come forward very quickly,” Bessent said. “If they come to the table with solid proposals, I think we can end up with some good deals.”

Ultimately, the hope would be to generate both jobs and revenue from the tariffs, he added.

“If we put up a tariff wall, the ultimate goal would be to bring jobs back to the U.S. But in the meantime, we will be collecting substantial tariffs,” Bessent said. “If we’re successful, tariffs would be a melting ice cube, in a way, because you’re taking in the revenues as the manufacturing facilities are built in the U.S., and there should be some level of symmetry between the taxes we begin taking in with the new industry from the payroll taxes as the tariffs decline.”

With the tariffs, Trump is hoping to open up more markets for American products and reshore manufacturing operations to the U.S. However, the administration is not simply focusing on absolute tariff levels from other nations but rather nontariff barriers such as currency manipulation, Europe’s value-added tax and other methods the White House says undermine fair trade.

“Everything is on the table,” Bessent said. “The academic literature shows that it’s actually the nontariff barriers which are harder, both harder to quantify and ... they’re more insidious because they’re hidden, they’re obfuscated.”

What we think: Treasury Secretary Bessent’s claim that China is playing a “losing hand” reveals the confidence—and risk—in the administration’s zero-sum view of trade. By focusing on the U.S.’s smaller export footprint to China, the administration justifies escalation without fear of proportional retaliation. But this framing ignores deeper economic linkages, especially in supply chains and investment flows. While Bessent outlines a vision of tariffs as temporary tools to drive reshoring and revenue, the real-world complexity of decoupling, enforcement, and transition costs could weigh on business sentiment.

China state firms pledge to boost share purchases to calm markets

Notable Snippet: Chinese state holding companies vowed on Tuesday to increase share investment while a slew of listed firms announced share buybacks as Beijing stepped up efforts to stabilise a stock market rocked by U.S. tariff woes.

The announcements by companies including China Chengtong Holdings Group (SASACA.UL) and China Reform Holdings Corp come a day after state fund Central Huijin said it would increase share holdings to steady markets.

China's stock market (.SSEC) rebounded on Tuesday, clawing back some of Monday's 7% slump, which was fuelled by trade war and global recession fears.

Washington last week imposed extra tariffs of 34% on China, which then fired back with its own 34% levies on U.S. imports.

China's retail dominated stock market "is vulnerable to irrational pull-backs when hit by unexpected, negative news," China International Capital Corp (CICC) said.

Investment by Huijin and other state investors "will not only provide direct liquidity support and break the vicious cycle, but also send a signal to calm market nerves."

Chengtong said its investment units would increase holdings in stocks and exchange-traded funds (ETFs) to safeguard market stability.

"We are firmly optimistic toward the growth prospects of China's capital markets," the state investment firm said in a statement, vowing to support high-quality growth of Chinese listed companies.

China Reform Holdings Corp, also known as Guoxin, said in a separate statement that an investment unit will increase holdings in tech companies, state firms and ETFs, tapping a relending scheme for share buybacks. Initial investment will be 80 billion yuan ($10.95 billion).

Another state holding company, China Electronics Technology Group, said it would boost share buybacks in listed units to bolster investor confidence.

What we think: The swift mobilisation of China’s state holding companies to stabilise markets reflects Beijing’s acute concern over investor confidence amid tariff fallout. The coordinated buybacks and direct equity support signal that policymakers are determined to prevent a deep correction. While these efforts may calm short-term volatility, they raise questions about long-term market independence and underscore the broader economic drag that could follow sustained U.S.-China decoupling.

US tariffs, China slowdown cloud developing Asia's growth outlook, says ADB

Notable Snippet: The full implementation of U.S. tariffs could cut developing Asia's growth by about a third of a percentage point this year and nearly a full percentage point in 2026, the Asian Development Bank said on Wednesday.

In its Asian Development Outlook report, the ADB projected that growth in developing Asia will ease slightly to 4.9% in 2025 — the slowest pace since 2022 — and slow further to 4.7% in 2026, from 5.0% in 2024.

lower growth in our baseline forecast," ADB chief economist Albert Park said.

Developing Asia, as defined by the ADB, is made up of 46 Asia-Pacific countries stretching from Georgia to Samoa - and excludes countries such as Japan, Australia and New Zealand.

Park said the eventual effects of the U.S. tariffs remain uncertain, as their scope and timing could change due to negotiations, delays, or exemptions being granted.

"On the flip side, stronger retaliation and further escalation could result in bigger impacts," he said.

"Additionally, the size and speed of policy changes under the new U.S. administration could reduce investment globally and in the region, while rising trade tensions and fragmentation would boost trade costs and disrupt global supply chains."

The weaker baseline projections already reflect an expected slowdown in China, with growth forecast at 4.7% this year, down from 5.0% in 2024, and slowing further to 4.3% in 2026.

Southeast Asia, which benefited from trade diversion during the 2018 U.S.-China trade war, is expected to lose some steam with growth in the subregion seen at 4.7% this year and next, down slightly from 4.8% in 2024.

A bright spot is South Asia, the ADB said, where strong domestic demand is projected to drive growth of 6.0% in 2025 and 6.2% in 2026, up from last year's 5.8%.

Sustained global demand for semiconductors should help underpin growth in developing Asia.

Regional inflation is forecast to ease to 2.3% this year and 2.2% next year, from 2.6% in 2024, due to falling prices of global oil and other commodities. This should allow central banks to continue monetary easing, the ADB said, although at a slower pace given expectations the U.S. Federal Reserve would keep rates elevated for longer.

What we think: The Asian Development Bank’s revised outlook offers a sobering assessment of the second-order effects of U.S. protectionism and China's structural deceleration. While growth in South Asia remains resilient, much of developing Asia is entering a phase of more subdued expansion.

Sentiment

FX

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord