Is Recession the new buzzword?

This is the time to be prudent and wait for clearer opportunities!

The first half of the year was all about inflation and the aggressive response from central bankers from the western economies. The second half now begins with the rising spectre of recession.

Should inflation not start to ease off as hoped for by the policymakers, the buzzword could quickly become stagflation and that would increase the fears of already confused investors.

With uncertainty remaining at a high level, this is the time to be prudent and wait for clearer opportunities!

Good luck in the 2nd half!

Trading Tip

Weather through the turbulence

Markets have been turbulent for the past few months and will likely continue until inflation numbers stabilise and recession fears subside. If you are already on the sidelines and not invested in the markets, it is prudent to wait for this storm to pass before starting to allocate capital or trade in smaller sizes if there are opportunities that you like.

If you’re invested, it is wise to reduce risk till there is more clarity on what the future holds.

Turbulent times will result in swings in your portfolio value that can be hard to stomach no matter how long you have been in trading. Understand that some troubles in life are avoidable and this is one of them.

Week Ahead

Monday: Independence Day in the US, US markets are closed

Tuesday: The RBA, in its policy meeting, is expected to hike interest rates by +0.50% to +1.35%.

Wednesday: US JOLTS Job Openings is expected to show a contraction in job openings given how companies are becoming more cautious in light of increasing fears of recession. .

Thursday: The Meeting Minutes for the Federal Reserve’s meeting in June will be released. Expect to hear about how the Fed will continue hiking till year end. US ADP Non-Farm Employment Change is expected to show job growth of 180k but we expect actual numbers to fall below given how recent economic numbers are pointing towards a slowdown.

Friday: US Unemployment Rate is expected to remain at 3.6% while Non-Farm Employment Change is expected to moderate to an increase of 275k jobs from previous month’s +390k.

Trading Plan

1. Currencies:

EUR - Short the EUR. Stay patient

Key resistance/support levels -

Resistance is at 1.0770-80. Support is at 1.0340-50

2. Commodities:

Uranium & Energy - Stay invested.

3. Stocks:

US Stock Index: An active trading day to start off the new quarter. Stocks ended positive despite increasing fears of a recession as evidenced by slowing economic data.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: The US Federal Reserve policymakers’ comments on their thoughts about future policy path will be key to market sentiment. The Ukraine-Russia war rages on, but the market impact is limited for now.

What Happened Yesterday

Eurozone Consumer Price Index (CPI), a measure of inflation, showed that prices rose 8.6% on a Year-on-Year basis (vs +8.3% expected). The core component (excluding food and energy) showed that the rise in price is +3.7% YoY (vs +3.9% expected). Inflation remains high in Europe and the ECB should continue to talk tough on it.

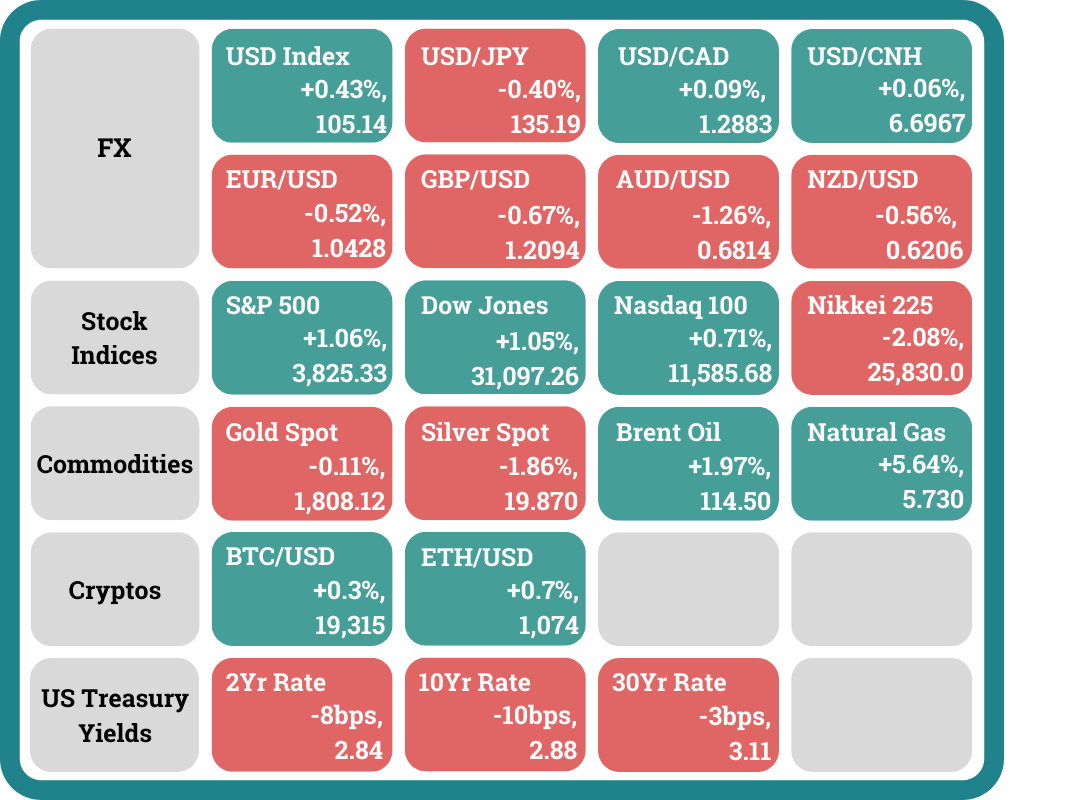

US yields continued its decline with the 10 yr yield hitting lows last seen in May. The 2 Yr yield dropped -0.08% to 2.84% while the 10 Yr yield fell -0.10% to 2.88%. The decline is attributed to the ISM Manufacturing PMI undershooting expectations of 54.9, coming in at 53.0. The ISM Manufacturing New Orders and Employment also disappointed with a print of 49.2 (vs 54 expected) and 47.3 (vs 50 expected) respectively. Readings below 50 suggest a contraction. The S&P Global Final Manufacturing PMI was 52.7 (vs 52.4 expected), shrinking from May’s figure of 57.

The US stock market seemed to show some signs of life as we head into the beginning of the second half of 2022. The S&P 500 rose by +1.06% (intraday low: -0.88%), the Dow Jones Index leapt +1.05% (intraday low: -0.95%) while the Nasdaq 100 increased +0.71% (intraday low: -1.08%).

The crypto market remained pretty stagnant over the weekend. Bitcoin held above 19,000, increasing +0.3% on Sunday. Ether clung above the 1,000 level as well, increasing +0.7% on Sunday to 1074.

Headlines & Market Impact

Chinese company’s purchase of North Dakota farmland raises national security concerns in Washington

Notable Snippet: At first glance, the largely barren, wind-swept tract of land just north of Grand Forks, North Dakota, seems to be an unlikely location for international espionage.

There’s not much on the more than 300-acre patch of prime Dakota farmland right now other than dirt and tall grasses, bordered by highways and light industrial facilities on the outskirts of the city.

The nearest neighbours include a crop production company, a truck and trailer service outfit, and Patio World, which sells landscaping supplies for suburban backyards.

That’s because the buyer of the land was a Chinese company, the Fufeng Group, based in Shandong, China, and the property is just about 20 minutes down the road from Grand Forks Air Force Base — home to some of the nation’s most sensitive military drone technology.

The base is also the home of a new space networking centre, which a North Dakota senator said handles “the backbone of all U.S. military communications across the globe.”

What we think: Whether it's a threat to the national defence or not, Chinese entities owning land in the bread basket of the US will make US citizens very uncomfortable. We may see the policymakers step in and limit Chinese presence in the region which will in turn affect the relations between the nations once again.

The last remnant of Facebook’s crypto project shuts down September 1

Notable Snippet: Meta plans to shutter its Novi digital wallet on Sept. 1, just eleven months after the company formerly known as Facebook debuted it.

The company announced the upcoming closure on Novi’s website, informing customers that “The Novi pilot is ending soon” and will no longer be available for use after that date.

At the time, Meta pitched Novi as an easy way for people to send and receive money with the help of the cryptocurrency Paxos Dollar, or USDP, stablecoin. At one point, Meta planned to issue and accept the Diem cryptocurrency, which was backed by a Facebook-led association, in conjunction with the Novi wallet.

However, the Diem cryptocurrency project, overseen by the Meta-backed Diem Association, faced intense scrutiny from regulators, which led to its demise.

What we think: More crypto projects will be washed out in the weeks and months ahead as the crypto market remains in the current winter season. This washout serves to clear out projects that are redundant or unviable in the market.

Eastern China cities tighten COVID curbs as new clusters emerge

Notable Snippet: Cities in eastern China tightened COVID-19 curbs on Sunday as coronavirus clusters emerge, posing a new threat to China's economic recovery under the government's strict zero-COVID policy.

Wuxi, a manufacturing hub in the Yangtze Delta on the central coast, halted operations at many public venues located underground, including shops and supermarkets. Dine-in services in restaurants were suspended, and the government advised people to work from home.

Si county in Anhui province locked down its 760,000 residents and suspended public traffic as it reported 288 cases on Saturday. Anhui accounted for most of China's new infections, reporting 61 symptomatic and 231 asymptomatic cases for Saturday.

Yiwu, China's export capital for small commodities, cancelled flights to the capital, Beijing, for an unspecified period, state TV said, citing COVID prevention measures. Yiwu has reported three COVID cases in the past week.

Shanghai, China's most populous city and financial hub, reported one positive case outside of quarantine areas in the city from midnight to 5 p.m. on Sunday (1600 GMT on Saturday to 0900 GMT on Sunday), officials told a news press conference.

What we think: Given China’s track record of dealing with Covid, we should see a lockdown of a month or two for some of the locations above depending on the number of cases in the days and weeks ahead. This may result in inflation in exports which may spill over into US inflation numbers.

Sentiment

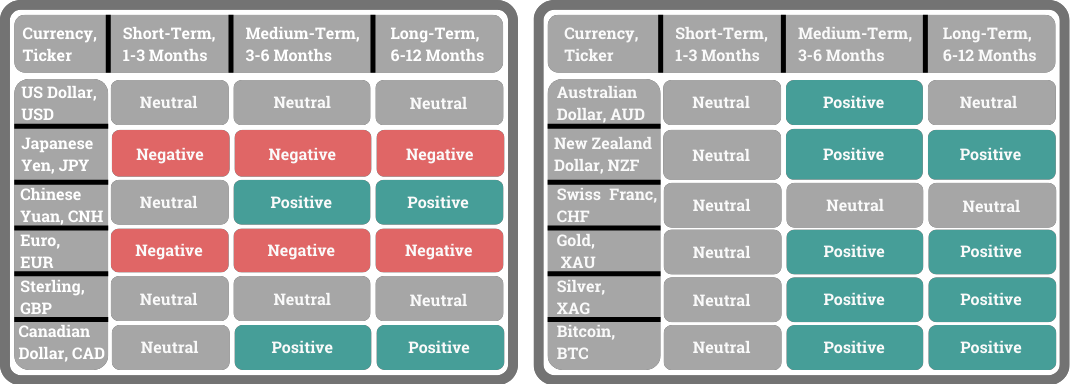

FX

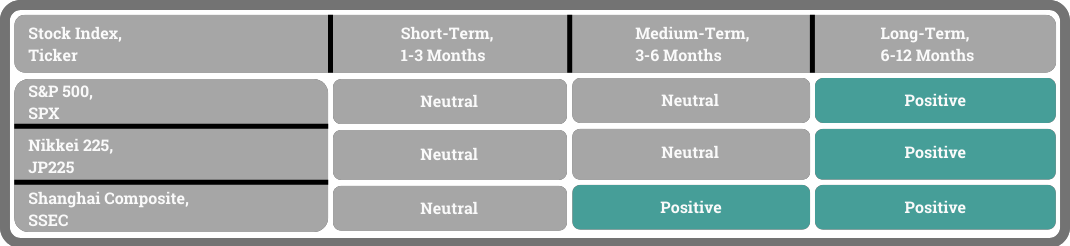

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord