The US JOLTS Job Openings report yesterday showed that available job vacancies in February dropped to 9.931 million, way below expectations of 10.4 million. The January figure was 10.563 million, revised from the initial estimate of 10.824 million. This is a clear sign that the job market is starting to weaken, and at a pace that is faster than expected by the market.

One of the reasons that the US Federal Reserve has been aggressively hiking interest rates was that they believe that the strong jobs market is keeping inflation high. As such, a strong jobs market will give them confidence to keep hiking if necessary.

However, they have hiked interest rates by a cumulative 4.75% since they started hiking early last year. We have seen the unintended consequences of their aggressive hiking in the form of bank failures last month. Could we be seeing more of the unintended damage in the weeks ahead?

The JOLTS number is volatile but it is the lowest in 2 years, and the first time it’s fallen below 10 million since May 2021. Should we see more cracks in the job market in the weeks ahead, the reasons for more interest rate hikes will be severely weaker.

Trading Tip

Don’t just keep doing what you’ve been doing

Even if what you’ve been doing works, you must be on a constant look out for ways to improve and for signs that what you have been doing may not be yielding the best results. This is a long-winded way of saying don’t get too comfortable and complacent.

This is especially true in trading because the only certainty about markets is that it is constantly changing. Even entrenched trends can exhaust themselves eventually. Constantly look for what’s the next best trade, as there will always be a next best trade even if the one you have right now is working well!

Day Ahead

US ISM Non-Manufacturing PMI is expected to decline to 54.5 from 55.1, indicating a slowdown in growth.

Trading Plan

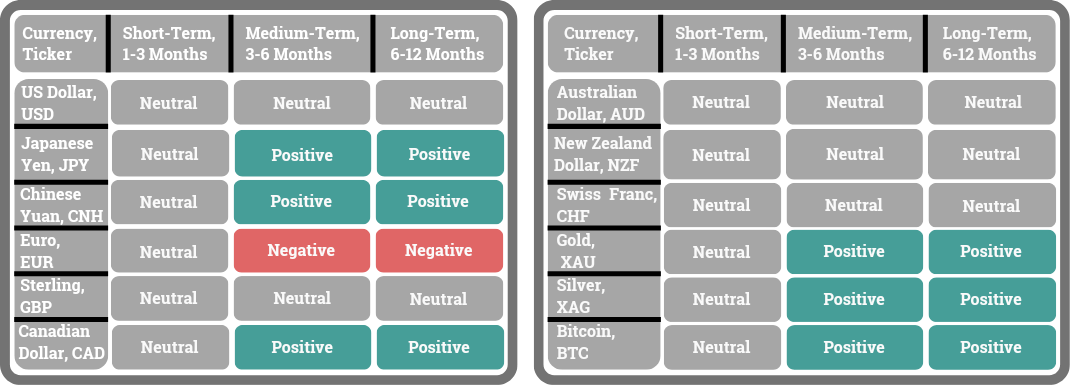

1. Currencies:

CNH - Bullish. Stay short USD/CNH.

2. Commodities:

Uranium & Energy - Stay invested.

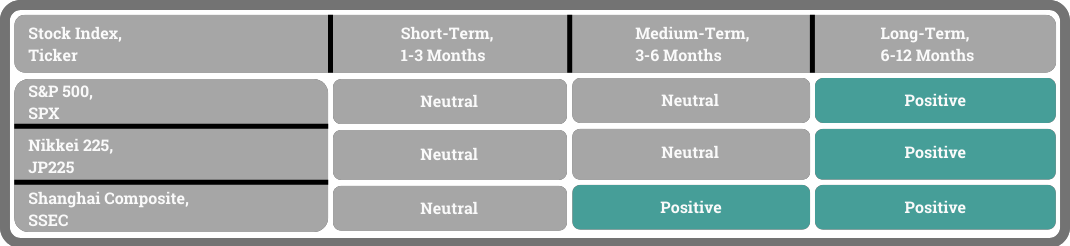

3. Stocks:

US Stock Index: The US stock market traded slightly lower as recession fears took hold of markets.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: Comments from US Federal Reserve officials may drive risk sentiment.

What Happened Yesterday

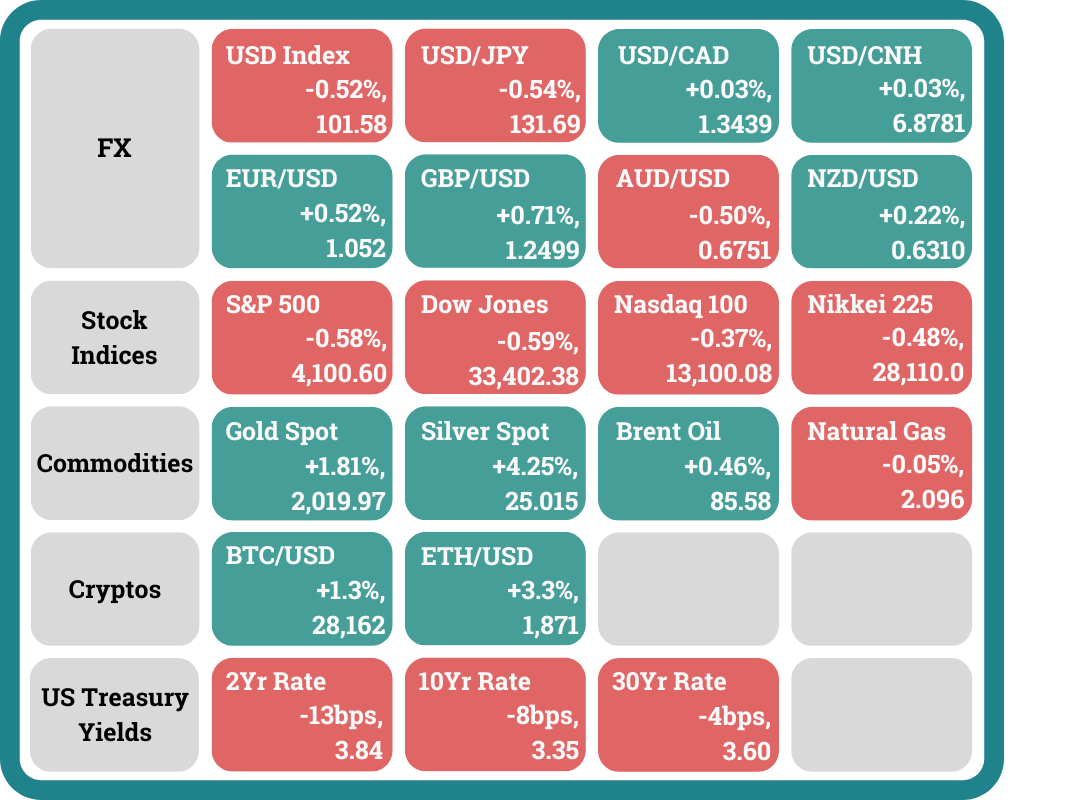

The Reserve Bank of New Zealand raised interest rates today by +0.50% (vs +0.25% expected) as the central bank emphasised on inflation being too high and persistent and that the employment level is too high and unsustainable. The bank also said that the need to lower demand to match supply within the economy remains. The NZD shot up close to the 0.638 level before settling +0.77% higher at the 0.635 level against the USD following the decision.

US JOLTs Job Openings for February slid 632k to a 2 year low of 9.93 million (vs 10.4M expected) This is the first time the data point fell below 10 million since May 2021. The largest decreases in job openings were in professional and business services at -278,000. This is a sign that the Federal Reserve’s attempt to slow down the labour market is starting to work.

The US Treasury Yield curve inversion narrowed further to 0.49%. The 2-year bond yield fell -0.13% while the 10-year yield slid -0.08% as the JOLTS number strengthens the case that the US Federal Reserve does not need to continue hiking interest rates aggressively.

Despite opening lower, the US stock futures were relatively flat during Asian trading hours. It then started to move higher in the London session with the S&P 500 futures rising +0.43% following Bank of England (BoE) interest rate-setter Silvana Tenreyro’s remarks that the BoE may have to cut rates sooner than thought.

The US stock market opened slightly higher from the previous day (the S&P 500 opened +0.09% higher). The market then started to make its way lower following the poor JOLTS report which might be a harbinger of a recession. As a result, S&P 500 closed -0.58% lower on the day (intraday high: +0.21%, intraday low: -0.91%), the Dow Jones Index slipped -0.59% (intraday high: +0.20%, intraday low: -0.97%) while the Nasdaq fell -0.37% (intraday high: +0.42%, intraday low: -0.75%).

The crypto market was encouraged by the jobs report with Bitcoin rising +1.30% and Ether spiking +3.3%

Headlines & Market Impact

Finland officially becomes a member of NATO, doubling the military alliance’s border with Russia

Notable Snippet: Finland on Tuesday became an official member of the NATO military alliance, prompted by Russian President Vladimir Putin’s decision to invade Ukraine last year.

The Nordic nation is the 31st country to join the alliance, which vows in its treaty that an attack on one of its members is an attack on them all. It’s a historic moment for Finland, which has followed a path of neutrality for decades.

Authorities in Helsinki decided that in the wake of Russia’s full-scale invasion of Ukraine in February 2022, the country was no longer safe on its own and applied to join the alliance a few months later. Finland shares an 832-mile border with Russia, the longest of any European Union member. NATO’s border with Russia will roughly double in size after Finland’s accession.

What we think: This has drawn the ire of Russia who started the offensive on Ukraine for fears of its membership into NATO. This will create more tensions between Russia and NATO.

Biden to discuss A.I. ‘risks and opportunities’ in meeting with science and tech advisors

Notable Snippet: President Joe Biden is set to discuss “risks and opportunities” of artificial intelligence in a meeting with his council of science and technology advisors on Tuesday, a White House official confirmed to CNBC.

The meeting, reported earlier by Reuters, indicates the level of attention the administration is paying to AI, which has reentered the limelight as accessible tools like ChatGPT have made the technology more concrete for many Americans.

Biden will discuss with his advisors the impact of AI on individuals, society and national security, the White House official said in a statement. The president will emphasise the importance of protecting rights and making sure there are “appropriate safeguards” around innovation.

Biden also will call for Congress to pass privacy legislation aimed at protecting children and putting limits on personal data collection for all Americans, according to the White House official.

What we think: Any controversial opinions and matters arising from the discussions should weigh on Artificial Intelligence stocks and induce some volatility for the time being. However, the longer and inevitable trend for more AI usage remains.

China warns US House Speaker not to meet Taiwan president

Notable Snippet: China warned US House Speaker Kevin McCarthy on Tuesday (Apr 4) not to "repeat disastrous past mistakes" and meet Taiwan President Tsai Ing-wen, saying it would not help regional peace and stability, but only unite the Chinese people behind a common enemy.

The Republican McCarthy, the third most senior US leader after the president and vice president, will host a meeting in California on Wednesday with Tsai, during a sensitive stopover in the US that has prompted Chinese threats of retaliation.

China, which claims Taiwan as its territory, staged war games around the island last August after then-Speaker Nancy Pelosi, a Democrat, visited the capital, Taipei.

No matter in what capacity McCarthy meets Tsai, the gesture would greatly harm the feelings of the Chinese people, send a serious wrong signal to Taiwan separatist forces, and affect the political foundation of Sino-US ties, it said in a statement.

"It is not conducive to regional peace, security nor stability, and is not in the common interests of the people of China and the United States," the consulate added.

What we think: If the visit should happen, it will antagonise China further and increase geopolitical tensions in the region.

Sentiment

FX

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord