The market is now in a holding pattern till the release of the latest inflation data from the US. The US CPI print for July will set the tone for how risk assets will be performing for the rest of the week.

After the super-strong jobs number last week, with the US Non-farm Payroll showing that +528,000 jobs were created in the US economy in July (vs expected +250,000), a higher-than-expected inflation print will likely mean that the US Federal Reserve will continue with its policy of outsized interest rate hikes of 0.75% increments.

That will weigh on risk assets which have been performing better of late. A softer print will reinforce the narrative that the Fed’s previous hikes are now starting to work and the Fed can afford to be more patient going forward.

Trading Tip

How do you know if you’re overinvested?

Trading will be a really harrowing experience if you are overinvested. You will be constantly looking at the charts and checking the prices every few minutes even on days that are relatively quiet.

Another indication that your positions are too big relative to your capital is that you are losing sleep worrying about your trading positions. While trading is a means to earn money, it should not be an activity that affects your health. Always size your trades correctly and reduce your risk when needed such that the toll on your mental health is minimal.

Day Ahead

The US Consumer Price Index (CPI) is expected to show that prices rose 8.7% on an annual basis. The number remains high and should weaken risk sentiment if expectations are exceeded.

Trading Plan

1. Currencies:

EUR - Short the EUR. Stay patient.

Key resistance/support levels -

Resistance is at 1.0340-50. Support is at 0.9990-1.0000

2. Commodities:

Uranium & Energy - Stay invested.

3. Stocks:

US Stock Index: Stocks continue to pull back on profit warnings from the major chipmakers.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: US inflation data (CPI) later today and the US Federal Reserve’s comments on their thoughts on the fight against inflation. The Ukraine-Russia war rages on, but the market impact is limited for now.

What Happened Yesterday

Market Movements as of New York Close 9 Aug 2022

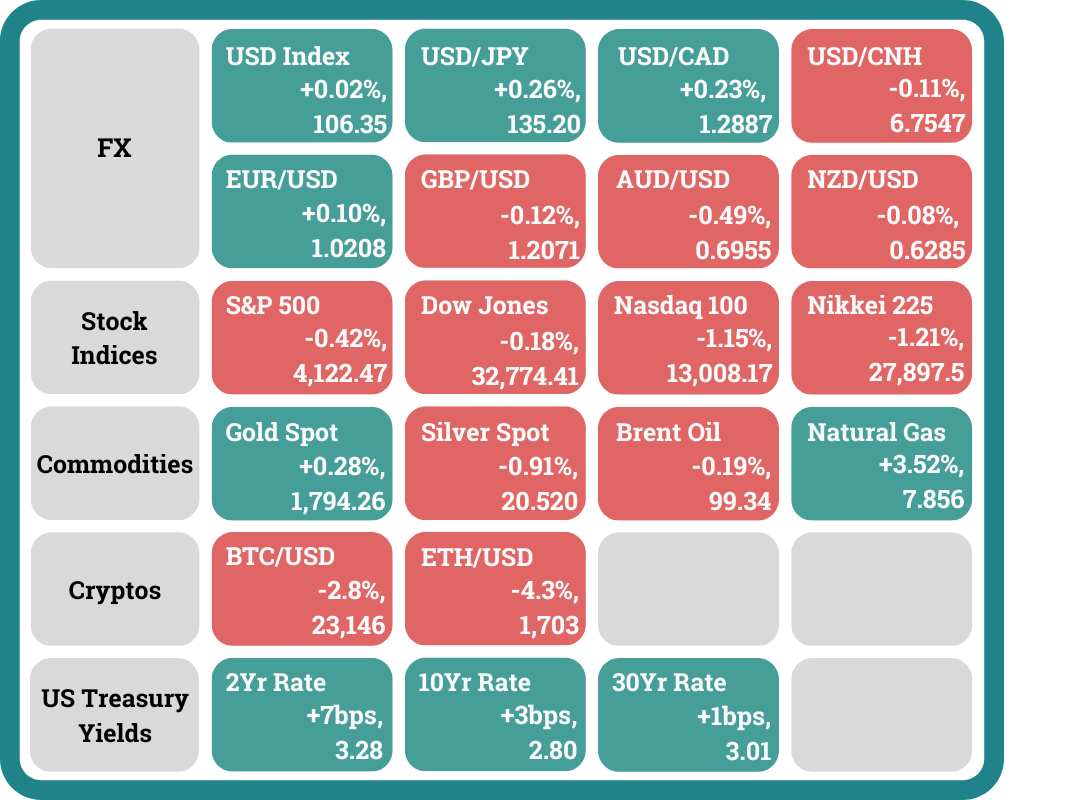

The US Treasury yield curve remains inverted with the difference in yields now at 0.48%. Treasury yields increased across the board in anticipation of a high US CPI print later today. The 2-year bond yield increased +0.07% to 3.28% while the 10-year bond yield rose +0.03% to 2.80%.

The US stock market seems to be weakening ahead of tonight’s CPI number. The S&P 500 dipped -0.42%, Dow Jones inched lower by -0.18% while the Nasdaq plunged -1.15%.

Micron warned of waning demand for chips in the market as customer inventories start to pile up. This came a day after Nvidia forecasted weakness in the gaming industry. Micron expects negative cash flow in the coming months and cut its revenue forecast for the current quarter.

The crypto market traded lower on the back of weaker risk sentiment. Bitcoin fell -2.8% to 23,146 while Ether dropped -4.3%.

Headlines & Market Impact

Biden signs China competition bill to boost U.S. chipmakers

Notable Snippet: President Joe Biden on Tuesday signed a bipartisan bill that aims to strengthen U.S. competitiveness with China by investing billions of dollars in domestic semiconductor manufacturing and science research.

“Today is a day for builders. Today America is delivering,” Biden said at the signing ceremony outside the White House. He was joined by a crowd of hundreds, including tech executives, union presidents and political leaders from both parties.

The bill, dubbed the Chips and Science Act, includes more than $52 billion for U.S. companies producing computer chips, as well as billions more in tax credits to encourage investment in semiconductor manufacturing. It also provides tens of billions of dollars to fund scientific research and development and to spur the innovation and development of other U.S. tech.

What we think: The bill is already attracting investment into the US technology manufacturing industry. Micron and Qualcomm have pledged billions to have manufacturing done in the US by 2030. More companies should follow suit in the future.

Taiwanese foreign minister says China drills part of a game-plan for invasion

Notable Snippet: Taiwan’s foreign minister said on Tuesday that China was using the military drills it launched in protest against U.S. House Speaker Nancy Pelosi’s visit as a game-plan to prepare for an invasion of the self-ruled island.

Joseph Wu, speaking at a press conference in Taipei, offered no timetable for a possible invasion of Taiwan, which is claimed by China as its own.

He said Taiwan would not be intimidated even as the drills continued with China often breaching the unofficial median line down the Taiwan Strait.

“China has used the drills in its military play-book to prepare for the invasion of Taiwan,” Wu said.

“It is conducting large-scale military exercises and missile launches, as well as cyberattacks, disinformation, and economic coercion, in an attempt to weaken public morale in Taiwan.

What we think: While many are downplaying this accusation, it is something to take note of as the impact on markets will be widespread if it should start to gain momentum.

Food prices fell sharply in July — but the respite may not last

Notable Snippet: Food prices dropped significantly in July from the previous month, particularly the costs of wheat and vegetable oil, according to the latest figures from the United Nations’ Food and Agriculture Organization.

But the FAO said that while the drop in food prices “from very high levels” is “welcome,” there are doubts over whether the good news will last.

“Many uncertainties remain, including high fertilizer prices that can impact future production prospects and farmers’ livelihoods, a bleak global economic outlook, and currency movements, all of which pose serious strains for global food security,” FAO chief economist Maximo Torero said in a press release.

The FAO food price index, which tracks the monthly change in the global prices of a basket of food commodities, fell 8.6% in July from the month before. In June, the index fell just 2.3% month on month.

However, the index in July was still 13.1% higher than July 2021.

What we think: While the trend lower seems hopeful for inflation numbers, we should note that inflation numbers are compared on an annual basis and the lower food prices should not have a huge impact till much later.

Sentiment

FX

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord