More volatility as the storm rages on…

Whatever the case may be, brace yourselves for yet another day of extreme volatility.

The meltdown in the crypto market continues as Binance has officially pulled out of its deal to buy FTX.com, one of the biggest crypto exchanges in the world. However, the focus of the traditional asset markets will be focused on the US Inflation data (US CPI) later today.

The market expects the CPI data to show that prices rose 7.9% in Oct when measured against the prices in Oct last year. Stripping out the volatile components of energy and food, prices are expected to have risen 6.5% for the same time period.

Should inflation be lower than expected, it will be a welcome relief for the market as it will reinforce the narrative that the US Federal Reserve can be more moderate in its interest rate hikes going forward as it will be a sign that its previous aggressive rate hikes are starting to work.

A surprise to the upside will be yet another brutal blow to the market that is already reeling from the contagion effects of the crypto meltdown.

Whatever the case may be, brace yourselves for yet another day of extreme volatility.

Trading Tip

More spillover effects ahead?

With FTX now on the brink of collapse and the crypto markets in shambles, we should gear ourselves for contagion risk as more crypto funds may be forced to liquidate with the current prices of bitcoin and ether especially if they are leveraged heavily into the market.

More blood will be spilled and more volatility will be ahead.

Day Ahead

The US Consumer Price Index is expected to show that prices rose 7.9% on an annual basis, down slightly from the previous print of 8.2%.

Trading Plan

1. Currencies:

EUR - Short the EUR. EUR is drifting lower again, as the USD strengthens amid risk aversion. Stay short.

2. Commodities:

Uranium & Energy - The break higher that was looking promising seems to have been interrupted by the risk aversion caused by the meltdown in cryptos. However, stay patient and stay invested.

3. Stocks:

US Stock Index: Active trading day as the stock market sold off due to the uncertainty caused by the meltdown in the crypto market. Stay vigilant and nimble.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: The US inflation data later today and the ongoing meltdown in the crypto market due to the likely bankruptcy of FTX, one of the biggest crypto exchanges in the world.

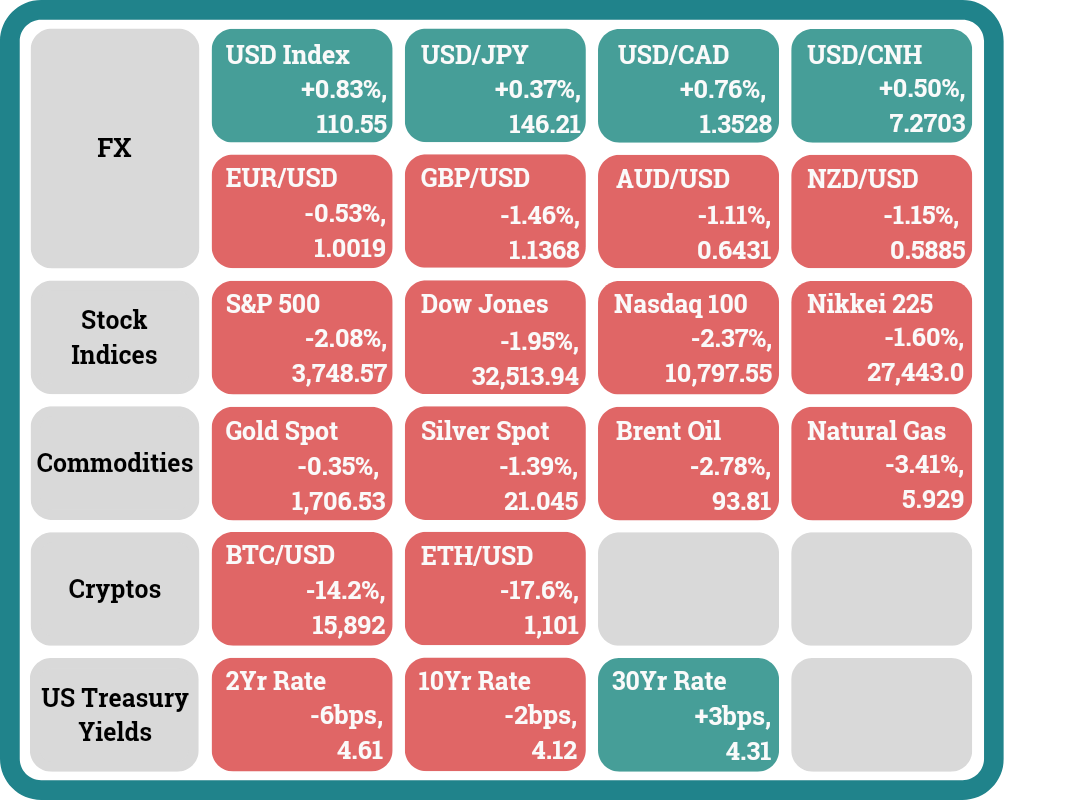

What Happened Yesterday

The US Treasury yield curve remains inverted with the difference between the 2-year and 10-year bond yields now at 0.49%. The 2yr yield fell -0.06% while the 10yr treasury yield slid -0.02% as risk aversion took hold of the market.

The US stock market fell due to risk aversion arising from FTX woes and the election results showing the Republicans did worse than expected . The S&P 500 fell -2.08% (intraday high: -0.26%, intraday low: -2.19%), the Dow Jones decreased -1.95% (intraday high: -0.30%, intraday low: -2.06%) while the Nasdaq slid -2.37% (intraday high: -0.45%, intraday low: -2.43%).

The crypto market suffered a catastrophic meltdown as Binance pulled out of its deal to acquire the non-US businesses of FTX after doing its due diligence. Bitcoin plummeted -14.2% (intraday high: +0.3%, intraday low: -15.8%) while Ether collapsed -17.6% (intraday high: +0.1%, intraday low: -19.4%). The FTT token fell another -59% following the -75% collapse the previous day, closing at the 2.3 level. The FTT token is now trading at the 2.4 level.

Headlines & Market Impact

Russia says troops leaving strategic Kherson, Ukraine doubts full pullout

Notable Snippet: Russian Defence Minister Sergei Shoigu ordered his troops to withdraw from the west bank of the Dnipro River near the strategic southern Ukrainian city of Kherson in a significant setback for Moscow and potential turning point in the war.

Ukraine reacted with caution to Wednesday's announcement, saying some Russian forces were still in Kherson and additional Russian manpower was being sent to the region.

Kherson city was the only regional capital Russia captured after its invasion in February, and it has been the focus of a Ukrainian counter-offensive. The city controls both the only land route to the Crimea peninsula that Russia annexed in 2014, and the mouth of the Dnipro, the river that bisects Ukraine. Russian-installed officials have been evacuating tens of thousands of civilians in recent weeks.

Kherson region is one of four that President Vladimir Putin declared in September he was incorporating into Russia "forever", and which Moscow said had been placed under its nuclear umbrella.

What we think: This is quite a notable development in the Ukraine war. But the situation remains volatile and may leave Putin with no choice but to resort to more desperate measures.

FTX CEO looking at all options as Binance deal collapses

Notable Snippet: FTX.com is also facing scrutiny from U.S. regulators over its handling of customer funds, as well as its crypto-lending activities. The U.S. Securities and Exchange Commission is investigating crypto exchange FTX.com's handling of customer funds amid a liquidity crunch, as well its crypto-lending activities, a source with knowledge of the inquiry said on Wednesday. Bloomberg first reported the probe.

FTX's woes are the latest sign of trouble in the fast-moving world of cryptocurrencies where prices have slumped this year as a broader downturn in financial markets prompted investors to ditch riskier assets.

Zhao earlier on Wednesday tweeted a letter to staff that there was no "master plan" behind the deal and that "FTX going down is not good for anyone in the industry" and is not a win.

Binance had not been the only possible partner sought. Prior to the Binance proposed deal, Bankman-Fried approached cryptocurrency exchange OKX on Monday morning about a deal, but the exchange declined to move forward.

What we think: Expect volatility to be high as the crypto market faces headwinds that are shaking investors' confidence in the market. As bitcoin's price continues to fall, more crypto institutions will be under financial stress.

Meta laying off more than 11,000 employees: Read Zuckerberg’s letter announcing the cuts

Notable Snippet: “Today I’m sharing some of the most difficult changes we’ve made in Meta’s history,” Zuckerberg said in the letter. “I’ve decided to reduce the size of our team by about 13% and let more than 11,000 of our talented employees go. We are also taking a number of additional steps to become a leaner and more efficient company by cutting discretionary spending and extending our hiring freeze through Q1.”

He said Meta is making reductions in every organization but that recruiting will be disproportionately affected since the company plans to hire fewer people in 2023. The company extended its hiring freeze through the first quarter with a few exceptions, Zuckerberg said.

“That means some teams will grow meaningfully, but most other teams will stay flat or shrink over the next year,” Zuckerberg said. “In aggregate, we expect to end 2023 as either roughly the same size, or even a slightly smaller organization than we are today.”

What we think: This should just be a sign of more layoffs to come. The economic outlook remains bleak but it is necessary as the Fed works towards its price stability goal.

Sentiment

FX

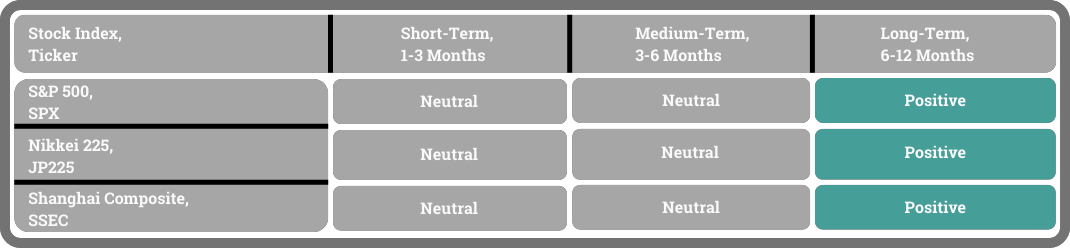

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord