Something positive to look forward to

China is now adamant on boosting growth, and the lifting of tariffs will be a win

News that China’s Vice Premier Liu He had a call with US Treasury Secretary Janet Yellen to discuss lifting the tariffs that the Trump administration imposed on $300 billion of Chinese goods cheered the market at the start of the Asian trading hours.

This is a positive development as any progress on this front will help ease inflation and also make China more willing to work on reopening their supply chains to the rest of the world.

China is now adamant on boosting growth, and the lifting of tariffs will be a win. That may make them more willing to tolerate more easing of Covid restrictions as a compromise to the US.

We will hear more about this in the days ahead, and that should improve risk sentiment if it becomes more likely to be achieved.

Trading Tip

It is OK to stay on the sidelines

When it comes to trading, people often think that we must always be invested at every single point of time or else we will be missing out on opportunities. Technically they are not wrong but what they often miss out is that cash itself is an asset class too.

There may be periods where the market is turbulent and riskier assets may not prove to be as good a store of value as cash. In these periods, it could be better to divest and not be invested in markets.

However, it is important to stay updated on the markets to find another opportunity as inflation will continue to eat into the value of cash.

Day Ahead

The RBA, in its policy meeting hiked interest rates by +0.50% to +1.35% as expected.

Trading Plan

1. Currencies:

EUR - Short the EUR. Stay patient

Key resistance/support levels -

Resistance is at 1.0770-80. Support is at 1.0340-50

2. Commodities:

Uranium & Energy - Stay invested.

3. Stocks:

US Stock Index: The US stock markets were closed yesterday for the US Independence Day holiday. Stock futures are starting out in Asia on a positive note due to news that the US may scrap trade tariffs on China.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: The US Federal Reserve policymakers’ comments on their thoughts about future policy path will be key to market sentiment. The Ukraine-Russia war rages on, but the market impact is limited for now.

What Happened Yesterday

US Markets were closed due to the Independence Day holiday.

*US Stock Indices are updated with futures prices as of 10 am Singapore Time as the US cash market was closed yesterday.

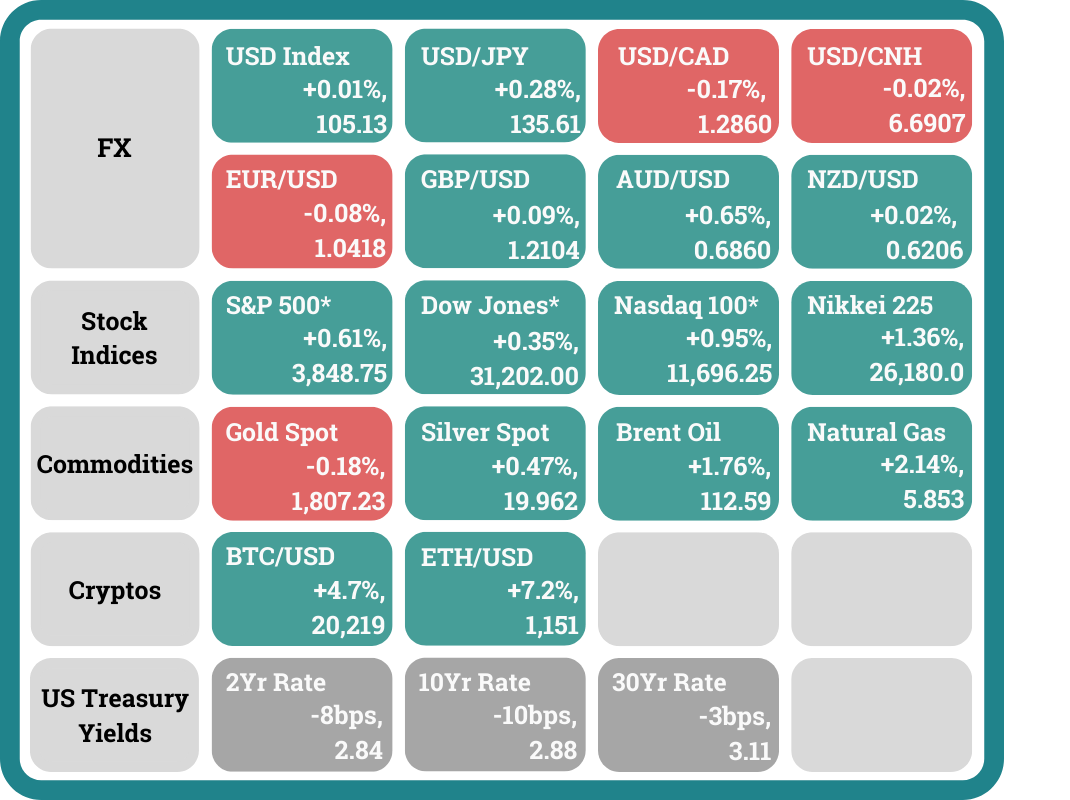

US stock futures and Asian Stock Indices rose in tandem at the beginning of the Asian trading session on news that China’s Vice Premier Liu He discussed US economic sanctions and tariffs in a call with Treasury Secretary Janet Yellen. This follows reports that the Biden administration may remove some Trump-era tariffs on Chinese consumer goods. Liu expressed that the lifting of tariffs and sanctions is of great interest to China and discussed stabilising global supply chains as well. The talks were said to be “constructive and pragmatic” according to a statement by the China’s Ministry of Commerce.

The crypto market rose due to the stronger risk sentiment. Bitcoin rose +4.7% to reclaim the 20,000 territory. Ether Climbed +7.2% bringing it to 1,151. Crypto lender Vauld, with US$1 billion assets under management, paused all withdrawals, trading and deposits on its platform following a blog post by its CEO that the company is facing financial challenges.

Headlines & Market Impact

Zelenskiy says Ukraine is in talks with Turkey, UN on grain exports

Notable Snippet: Ukraine is holding talks with Turkey and the United Nations to secure guarantees for grain exports from Ukrainian ports, President Volodymyr Zelenskiy said on Monday.

"Talks are in fact going on now with Turkey and the U.N. (and) our representatives who are responsible for the security of the grain that leaves our ports," Zelenskiy told a news conference alongside Swedish Prime Minister Magdalena Andersson.

Zelenskiy said Ukraine was working "directly" with U.N. Secretary General Antonio Guterres on the issue and that the organisation was "playing a leading role, not as a moderator."

What we think: Developments on this front will alleviate the inflationary pressures on food prices we see worldwide at the moment. Grain is an essential raw material needed for farming and the limited supply is exerting pressure on poultry and meat production.

British Army’s Twitter and YouTube accounts hacked to promote cryptocurrency scams

Notable Snippet: The army’s Twitter and YouTube profiles were taken over by the hacker, or hackers — the identity of whom is not yet known — on Sunday. The Twitter account’s name was changed to “pssssd,” and its profile and banner pictures were changed to resemble a nonfungible token collection called “The Possessed.”

The Possessed’s official Twitter account warned users of a “new verified SCAM account” impersonating the collection of NFTs — tokens representing ownership of pieces of online content.

It’s not the first time a high-profile social media account has been exploited by hackers to promote crypto scams. In 2020, the Twitter accounts of Musk, President Joe Biden and numerous others were taken over to swindle their followers of bitcoin.

What we think: All will flock to where money can be made. Sure this paints a bad picture of cryptocurrencies but note that scams occur everywhere and the focus on cryptocurrencies is due to its novelty. Exercise extra caution and do the required checks before connecting your wallet to any site. Note that the discord channels can be compromised as well and the links sent on there may not be legitimate.

Here are the China trends investors bet money on during a sluggish few months

Notable Snippet: By the numbers, manufacturing companies in China snagged the most investment deals in the first half of the year among 37 sectors tracked by business database Qimingpian.

In fact, the number of early-stage to pre-IPO deals in manufacturing rose by about 70% year-on-year despite Covid controls and a plunge in Chinese stocks during the last six months.

About 300, or roughly a quarter of those deals, were related to semiconductors, preliminary data showed. Several of the investors listed were government-related funds.

Data on early-stage investments aren’t always complete due to the private nature of the deals. But available figures can reflect trends in China.

Manufacturing accounted for about 21% of investment deals in the first half of the year, according to Qimingpian. The second-most popular industry was business services, followed by health and medicine.

What we think: With China’s expansionary policy in force, the country seems to be a good place to park money in while the rest of the world is tightening. However, finding the key industry remains tough as the slowdown in global demand may spillover into China as well.

Sentiment

FX

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord