The Aggressive selling continues but what next?

As we have been saying, volatility is likely to remain high for now...

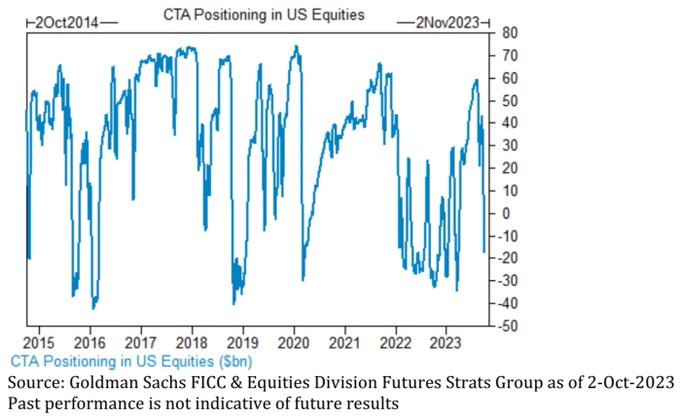

According to investment bank Goldman Sachs, Commodity Trading Advisors (CTAs) have been selling large amounts of US stocks over the last two weeks. This is the largest 2-week selling since Covid) and they reportedly sold around $59 billion and are now net short $17.5 billion USD of stocks.

CTAs are typically trend and momentum-following funds. It seems that the US Federal Reserve’s message of “higher interest rates for longer” and the subsequent rise in longer maturity US bond yields have triggered their selling spree.

Data on the US jobs market this week (US JOLTS job vacancies, ADP employment change, US Non-Farm Payrolls) will give us an updated picture of how strong the jobs market is. If the job market should remain tight or even get stronger, the chances of the Fed hiking further will increase. This is likely to result in even more selling by these momentum funds. However, if we see a significant moderation, the pressure for the Fed to keep raising interest rates will ease, and we could see a significant bounce in the stock market.

As we have been saying, volatility is likely to remain high for now, as risk sentiment continues to be highly dependent on how inflation and the job market evolve from here.

Trading Tip

What's Easier than Making Money?

In this age of social media, there are many traders who post about the "trader lifestyle" to brag to others. These posts often come with captions talking about how easy it is to profit from trading. As a result, many are enticed to start trading, often without the right knowledge of what it takes to succeed.

Little do they know about the hard work and the discipline traders must have in order to succeed. Hence, the people who were enticed will often seek out the "Holy Grail" marketed by gurus that don't work.

If this sounds familiar, let this be a reminder to you that, yes, getting started on trading is easy. It’s just a matter of a few clicks these days. To make money from trades is also not that difficult, but the problem is that to lose money is infinitely easier.

To be consistently profitable over the long run, you must be in it to win it and sheer hard work and determination is required. Even if you have all that, you still need to find sources of trusted information to get the knowledge that you need!

Day Ahead

The US JOLTS job opening is expected to show a modest rise in the number of jobs available to 8.83 million in August from 8.827 million in July.

Trading Plan

1. Currencies:

Neutral

2. Commodities:

Uranium & Energy - Stay invested for now.

3. Stocks:

US Stock Index: The US stock market was relatively flat on the day as the market balanced both positive and negative market drivers. Tech stocks remain a main driver as optimism over AI remains.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: The JOLTS job opening data could cause some market volatility if it diverges significantly from market expectations. Comments on US inflation and path of future policy by US Federal Reserve officials may affect risk sentiment.

What Happened Yesterday

Fedspeak:

Barr (current voter, slight hawk): “The most crucial question is not how much higher interest rates will go but rather how long they will remain at a sufficiently restrictive level."

Bowman (current voter, slight hawk): “Willing to support rate increase at a future meeting if data indicates progress on inflation has stalled or is too slow to return to it to 2% in a timely way.”

Mester (2024 voter, known hawk): “Higher rates are needed to make sure the disinflation process continues. The Fed will likely need to hike rates one more time this year."The RBA (Reserve Bank of Australia) maintained policy interest rate at 4.1%, as expected. Muted market reaction.

The Euro Area unemployment rate dipped slightly to 6.4% in August as expected from 6.5% in July (revised from 6.4%). EUR reaction to the data release was muted.

The ISM Manufacturing Purchasing Managers Index improved to 49 in September (vs 47.8 expected) from 47.6 in August. The S&P Global Manufacturing PMI improved to 49.8 (vs 48.9 expected) in September from 47.9 in August. While a lower than 50 print indicates a contraction, it is encouraging to see improvements in the PMI prints that are higher than expected.

The US Treasury Yield curve inversion narrowed slightly to 0.43% as the US 2-year bond yield rose +0.09% to 5.12% while the 10-year bond yield rose +0.10% to 4.69%.

The US stock futures remained in a range through the Asian trading session before experiencing some downward momentum into the London trading session. The S&P 500 futures were down -0.33% from Friday’s close before the New York session began.

The US stock market opened lower from Friday. It then rose on the release of the PMI numbers but started falling following hawkish comments from Fed officials. Consequently, the S&P 500 closed almost unchanged at +0.01% (high: +0.29%, low: -0.65%), the Dow fell -0.22% (high: +0.01%, low: -0.86%) while the Nasdaq gained +0.83% (high: +1.20%, low: -0.09%) as chip makers rose across the board after Goldman Sachs added Nvidia (+2.95%) to its conviction list of top stock picks.

Despite news of Coinbase obtaining its payment licence in Singapore and Grayscale’s filing to convert its Ethereum Trust to a spot ETH ETF, the crypto market fizzled out on the back of higher US yields. Bitcoin and Ether fell -1.8% and -4.1% on the day respectively.

Headlines & Market Impact

Bank of Japan hikes bond buying as benchmark yields hit decade peak

Notable Snippet: The Bank of Japan announced it’s increasing its bond purchases at Wednesday’s auction, as a spike in government bond yields tests its resolve to defend its yield curve control policy.

In a statement Monday, the Japanese central bank said it will conduct an unspecified amount of additional purchases of Japanese government bonds with tenures of more than five years and up to 10 years. This adds to the BOJ’s reported 300 billion yen ($2 billion) Friday bond purchase with similar maturities.

Yields on 10-year Japanese government bonds hit as much as 0.775% on Monday, their highest since September 2013 and nearing the BOJ’s hard 1% cap. The yen shed nearly 0.3% to about 149.73 yen against the dollar, nearing the 150 yen level that prompted BOJ intervention last year.

What we think: The BoJ remains on the dovish side for now as it seeks to maintain low interest rates even as speculators continue to bet on higher rates on Japanese government bonds.

Exclusive: US warned China to expect updated export curbs in October-US official

Notable Snippet: The Biden administration warned Beijing of its plans to update rules that curb shipments of AI chips and chip making tools to China as soon as early October, a U.S. official said, a policy decision aimed at stabilising relations between the superpowers.

The Commerce Department, which oversees export controls, is working on an update of export restrictions first released last year. The update seeks to limit access to more chip making tools in line with new Dutch and Japanese rules, other sources said, and to close some loopholes in export restrictions on artificial intelligence (AI) chips.

“The Administration narrowed in on or near the one-year anniversary for a number of reasons – including to establish a clear cadence,” the official said.

But, the official added, the technical work needed to finalise the restrictions was not yet complete. "As of this moment, final plans are not in place," the official said on Friday.

What we think: More restrictive export curbs will weigh on risk sentiment and increase the risk that China will respond with restrictions on Chinese exports of rare earth metals to the rest of the world.

Fed policymakers see rates staying high for 'some time'

Notable Snippet: U.S. Federal Reserve officials say that monetary policy will need to stay restrictive for "some time" to bring inflation back down to the Fed's 2% target, but their unity around that phrase masks an ongoing debate over another possible rate hike this year.

"I remain willing to support raising the federal funds rate at a future meeting if the incoming data indicates that progress on inflation has stalled or is too slow to bring inflation to 2% in a timely way," Fed Governor Michelle Bowman said Monday in prepared remarks to a banking conference.

Speaking at a separate event in New York on Monday, Fed Vice Chair for Supervision Michael Barr said he believes rates are now "at or very near" a sufficiently restrictive level.

Fed Chair Jerome Powell, who on Monday was visiting York, Pennsylvania to get an up-close view of how businesses and workers are experiencing the economy, last month also said restrictive policy would be needed "for some time," as did the influential chief of the New York Fed, John Williams, on Friday.

Meanwhile, speaking Monday evening, Cleveland Fed leader Loretta Mester also said the Fed's work is likely not done.

“I suspect we may well need to raise the fed funds rate once more this year and then hold it there for some time as we accumulate more information on economic developments and assess the effects of the tightening in financial conditions that has already occurred,” Mester said in a speech to a group in Cleveland.

"The only way to square those would be to have a somewhat higher-for-longer rate path," Richmond Fed President Thomas Barkin said in an interview on Bloomberg's "Odd Lots" podcast conducted last Thursday but aired Monday.

What we think: While some policymakers are calling for another hike, if the economic numbers continue to support the case for softer inflation and a moderating labour market, it is likely that we are at the end of the Fed hiking cycle.

Sentiment

FX

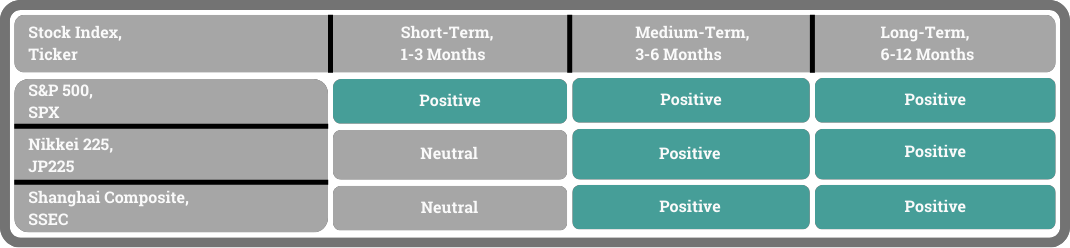

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord