The good news was that the market received another confirmation that inflation is moderating at a faster pace than expected as the US Producer Price Index showed that prices at the producer level rose +8.0% year-on-year, lower than the expectation of a +8.3% and the print of 8.4% from the previous month.

Lower-than-expected inflation means the previous aggressive interest rate hikes by the US Federal Reserve is starting to work -> Less need for the Fed to continue hiking aggressively and more reason for the Fed to be more patient and allow the impact of previous hikes to filter through the economy -> Less aggressive hikes, better for stocks and risk assets.

The bad news was that Russian missiles (allegedly) hit a village in Poland that was near its border with Ukraine, killing 2 Polish citizens -> Risk of Poland invoking Article 5 of NATO which calls for all NATO nations to defend Poland should it decide to respond against Russia -> more uncertainty -> bad for risk sentiment and risk assets.

However, despite that bad news, it is telling that the stock market still ended in positive territory with the Nasdaq up +1.5% and the S&P500 up +0.9%. Should the Poland situation escalate, risk sentiment will weaken. If Poland & NATO decide not to escalate this (if the missile turns out not to be of Russian origin as claimed by Russia, or it was not intentional and was debris from Ukrainian missiles shooting down Russian missiles), risk sentiment will likely continue to strengthen as the peak inflation narrative continues to take hold.

Trading Tip

The wrong kind of Consistency may not be the key

Some people have a set amount they expect to earn from trading everyday — like what they will expect from drawing a salary from their jobs. But that is impossible for retail trading as they will have to be able to call trades regularly on a consistent basis.

In fact, for retail traders to do so, they will only be consistently profitable if they take small profits at the risk of losses that are multiples of the small profits. Over the long run, this will inevitably lead the trader to the poor house.

Day Ahead

The UK Consumer Price Index (CPI) is expected to show increasing price pressures at +10.6% from last month’s 10.1% Year-on-Year in the region while the Canadian CPI is expected to remain at 6.9% Year-on-Year. US Retail Sales is expected to rise 6.9% on an annual basis (down from 8.2% previously).

Trading Plan

1. Currencies:

EUR - Short the EUR. EUR breaks resistance at 1.0370-1.0380 briefly to hit a high of 1.0480 due to the weak US PPI data before retracing back below that level on news that Russian missiles hit a village in Poland. The USD retracement from the highs continues, and EUR continues to benefit. Stay short for now, but risk reduction is required should resistance at 1.0490-1.0500 breaks.

2. Commodities:

Uranium & Energy - Stay patient and stay invested.

3. Stocks:

US Stock Index: Stocks rallied strongly with Nasdaq rising more than 3% pre-market in reaction to the softer inflation data (US PPI), but gave back some of the gains due to headlines that Russian missiles may have hit a village in Poland (which is part of Nato). Still, the market ended in positive territory with Nasdaq up 1.5% on the day. Expect volatility to remain high.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: Comments from the US Federal Reserve concerning their views on the recent inflation data and future interest rate hikes might affect risk sentiment. The Poland/Russia situation is a key geopolitical risk as it could draw NATO into the Russian conflict.

What Happened Yesterday

The US Producer Price Index showed that prices for producers rose 8% (vs 8.3% expected) Year-on-Year, declining from the previous print of 8.4% The core index which exclude volatile components such as food and energy also exhibited moderating inflationary pressures with a print of 6.7% YoY (vs 7.2% expected and 7.1% previous)

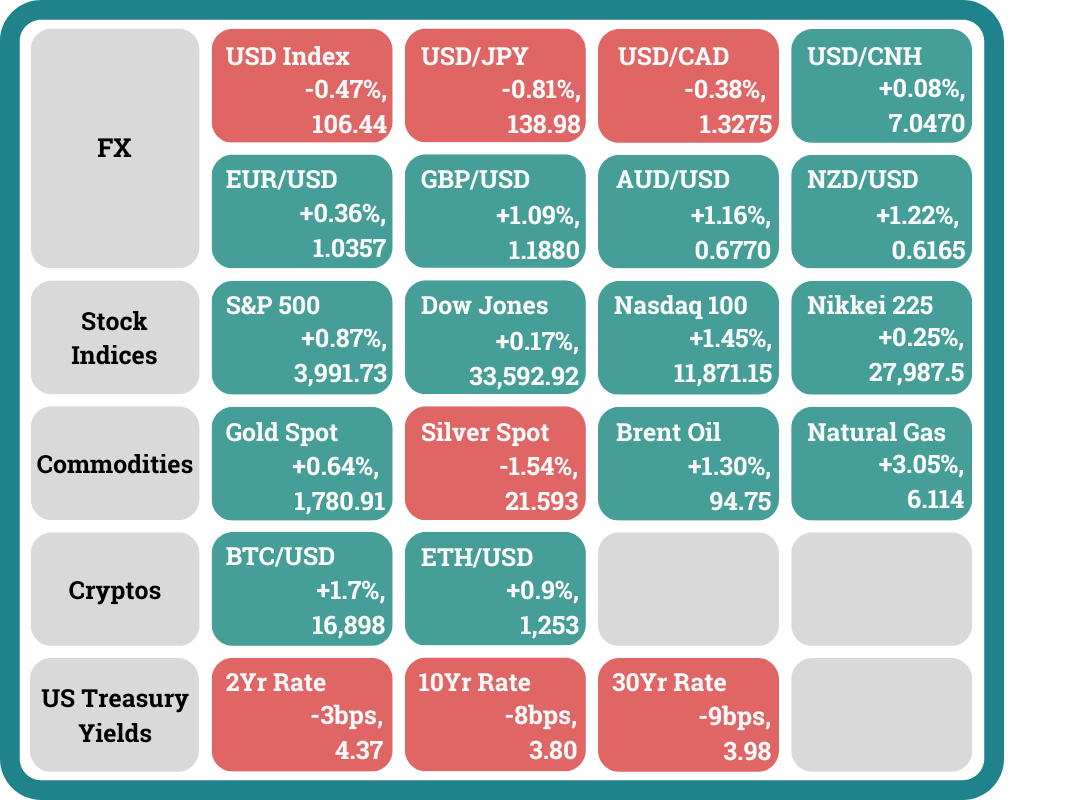

The US Treasury yield curve remains inverted with the difference between the 2-year and 10-year bond yields now at 0.57%. Both the 2yr yield declined -0.03% while the 10yr treasury yield dropped -0.08% as the lower PPI numbers reinforced hopes that the US Federal Reserve interest rate hikes will be in small increments in the future meetings.

The US stock market started the day higher following the PPI number but then fell from the highs following news that Russian-made missiles hit Poland. The S&P 500 rose +0.87% (intraday high: +1.81%, intraday low: -0.10%), the Dow Jones inched higher by +0.17% (intraday high: +1.34%, intraday low: -0.64%) while the Nasdaq added +1.45% (intraday high: +2.76%, intraday low: +0.30%). In reaction to the PPI release, the S&P 500 futures spiked to an intraday high of +2.14%, the Dow futures had an intraday high of +1.39% while the Nasdaq futures had an intraday high of +3.27%.

The crypto market continued its trajectory higher from Monday’s momentum due to the PPI numbers. Bitcoin rose +1.7% (intraday high: +3.0%, intraday low: -0.4%) while Ether rose +0.9% (intraday high: +3.8%, intraday low: -0.6%).

Headlines & Market Impact

Crypto.com customers worry it could follow FTX, as CEO tries to reassure them everything’s fine

Notable Snippet: Like FTX, which filed for bankruptcy protection Friday, Crypto.com is privately held, based outside the U.S. and offers a range of products for buying, selling, trading and storing crypto. The company is headquartered in Singapore, and CEO Kris Marszalek is based in Hong Kong.

Twitter lit up over the weekend with speculation that Crypto.com was facing problems, and crypto experts held Twitter Spaces sessions to discuss the matter. Meanwhile, revelations landed Sunday that, in October, Crypto.com mistakenly sent more than 80% of its ether holdings, or about $400 million worth of the cryptocurrency, to Gate.io, another crypto exchange. It was only after the transaction was exposed through public blockchain data that Marszalek acknowledged the mishap.

Changpeng Zhao, CEO of rival exchange Binance, fanned the flames of speculation, tweeting Sunday that an exchange suddenly moving large amounts of crypto like that “is a clear sign of problems.” He added, “Stay away.”

Confidence is clearly shaken. Crypto.com’s native cronos token (CRO) has dropped nearly 40% in the last week. The crumbling of FTX’s FTT token was one sign of the crisis that company faced.

What we think: All rumours start from somewhere. The crypto market is now facing an extremely harsh winter and exchanges are being caught in the snowstorm. It is difficult to ascertain which exchanges will survive and it is imperative to move your crypto to a place you can trust.

Jobless rate rises as UK prepares to tighten belts again

Notable Snippet: Britain's unemployment rate unexpectedly rose and vacancies fell for a fifth report in a row as employers worried about the outlook for the economy, official data showed on Tuesday, ahead of a tough government budget plan later this week.

But pay growth stayed strong, with the increase in basic pay hitting a record high excluding the pandemic period, keeping pressure on the Bank of England to continue raising borrowing costs despite the economic slowdown.

However, the level of vacancies is still high by historical standards, underscoring the problems facing many employers struggling to fill their empty roles.

The BoE fears that Britain's shrinking labour market will add to inflation pressures, forcing it to keep on raising rates even as the economy heads into an expected recession.

What we think: The UK has been stuck between a rock and a hard place and will continue to be so in the months ahead. The terrible economic outlook and mounting inflation will limit the GBP's upside.

Apple will buy processors from factory in Arizona, CEO Tim Cook reportedly says

Notable Snippet: “We’ve already made a decision to be buying out of a plant in Arizona, and this plant in Arizona starts up in ’24, so we’ve got about two years ahead of us on that one, maybe a little less,” Cook said, according to Bloomberg.

TSMC previously announced plans for a single factory in Arizona to open in 2024 focusing on chips that use the latest manufacturing technology. TSMC said earlier this month that it is planning a second chip factory in Arizona because of “strong customer demand.”

U.S. politicians have worried that having companies like Apple source advanced and expensive parts from Taiwan could present risk and create chaos if China ever invaded the island nation. Cook reportedly said during the meeting that 60% of the world’s processors come out of Taiwan.

What we think: Where there is demand, there will be supply. This is another sign that global tensions are leading to the onshoring, and reshoring trend that we are seeing.

Sentiment

FX

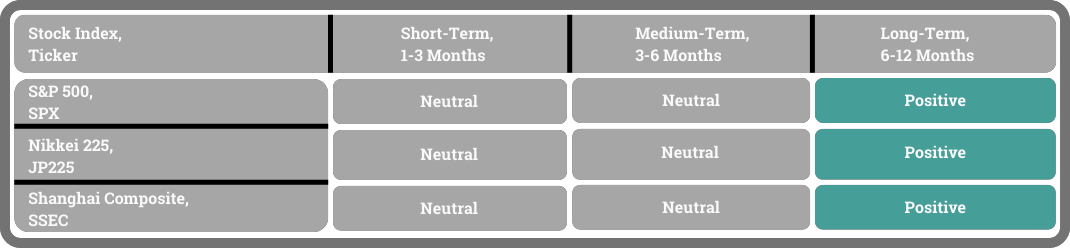

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord