Since ChatGPT, an Artificial Intelligence chatbot (https://chat.openai.com/) developed by OpenAI, was launched in Nov 2022, the world has been constantly surprised by the things that the chatbot can do when given simple and clear prompts.

The importance of the battle for supremacy in AI was starkly demonstrated yesterday when Alphabet (GOOGL), the parent company of Google lost more than 7% (>100 billion dollars) of its market capitalisation when its version of the AI chatbot, Bard, gave an erroneous answer in an event to unveil this new addition to its offering.

Whoever wins this battle to create the better AI chatbot, the productivity gains that will be seen in the months ahead can not be underestimated. It is not just higher interest rates and a slowing economy that will be adding disinflationary pressures to the global economy.

The unprecedented gains in productivity will change the landscape of many industries in the months and years ahead. Change is inevitable and coming fast. Embrace it and avoid being swamped by it.

Trading Tip

When does consistency matter in trading?

When it comes to consistency in trading, many would want to have consistent profits with their trades. In other words, they want to have most of their trades to be winning trades as it should translate to a higher win ratio and overall profitability.

However, consistently winning in trading is almost near impossible. It is extremely difficult to keep having winning trades as markets can diverge from your views very easily even if your thesis is right.

Instead, it is imperative to be consistent in your trading process instead. Have clearly defined exits from your positions so that you will be able to get out of position quickly when things go awry and also stick to your positions when things are going well. By being consistent in your process, you will be less susceptible to bad trades and that will eventually lead you to profitability.

Day Ahead

The Bank of England monetary policy committee is due to testify on inflation and the economic outlook before Parliament's Treasury Committee. We will get more insights on how the BoE foresees inflation falling to 4% by the end of this year through their testimonies.

Trading Plan

1. Currencies:

CNH - Bullish. Stay short. When the upside momentum fades, it will be time to add to our short positions.

2. Commodities:

Uranium & Energy - Stay patient and stay invested.

3. Stocks:

US Stock Index: The stock market weakened following Waller’s comments about keeping rates higher for longer and Google’s flub with its AI chatbot.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: US Federal Reserve officials’ comments on the unexpectedly strong US jobs market and the future path of interest rates will influence risk sentiment.

What Happened Yesterday

Fedspeak:

Waller (current voter, known hawk): “We are seeing that effort begin to pay off, but we have farther to go.”, “And, it might be a long fight, with interest rates higher for longer than some are currently expecting. But I will not hesitate to do what is needed to get my job done.”

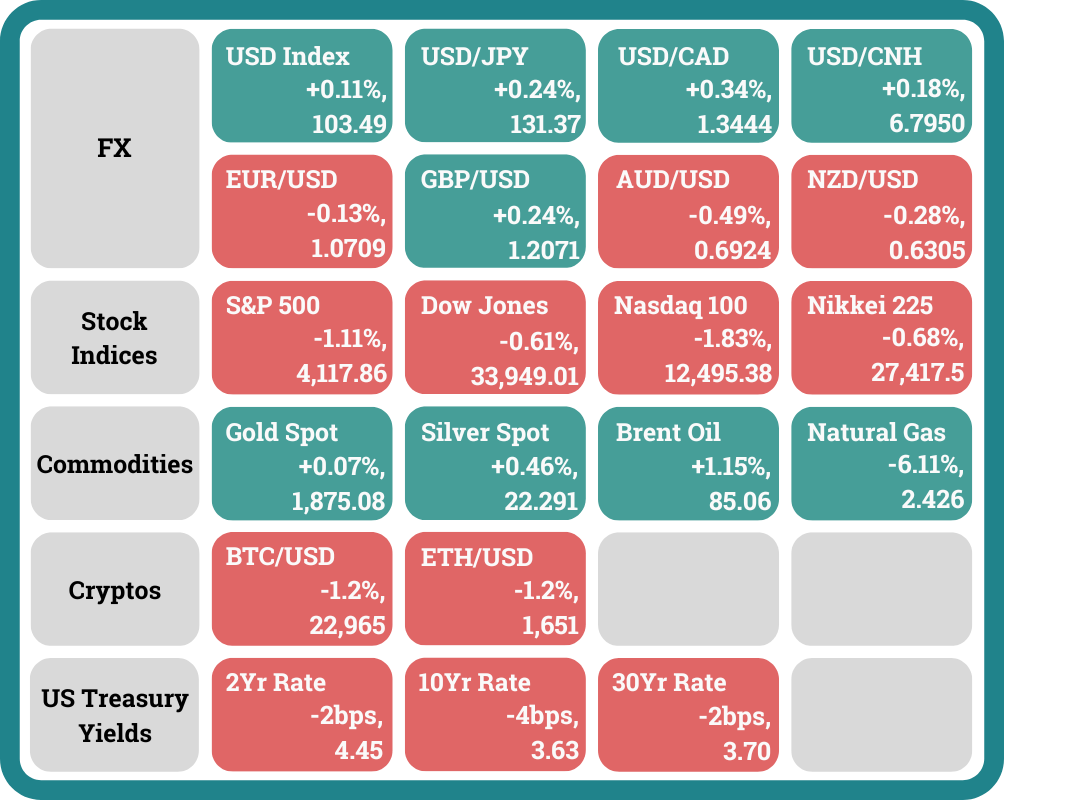

The US Treasury yield curve remains inverted with the difference between the 2-year and 10-year bond yields now at 0.82%. The 2yr yield fell -0.02% to 4.45% while the 10yr yield fell -0.04% to 3.63%.

The US stock futures traded within a small range during the Asian hours, with the S&P 500 futures moving +0.26% by Asian midday from 4167 to 4178 and then -0.31% down to 4165 by the end of the trading session. Risk sentiment then weakened during the London trading session with the S&P 500 futures falling -0.29% to 4153 just before the New York trading session started.

The US stock market opened a tad lower as a result (S&P 500 opened -0.40% compared to the previous close) and made its way lower with the S&P 500 falling -0.80% to a low of 4113 as risk sentiment continued to weaken due to an error during Alphabet’s AI showcase (Google’s rival to ChatGPT, Bard, gave an incorrect answer in its online advertisements which resulted in GOOGL being down -7.68% on the day) and Waller’s comments. The US stock market then attempted to bounce from the lows but ultimately cave in and closed near the lows of the day. As a result, S&P 500 closed the day -1.11% lower (intraday high: -0.17%, intraday low: -1.26%), the Dow Jones Index slid -0.61% (intraday high: +0.01%, intraday low: -0.75%) while the Nasdaq slipped -1.83% (intraday high: -0.15%, intraday low: -2.02%).

The crypto market weakened due to the weaker risk sentiment in the broader market. Bitcoin and Ether both fell -1.2%..

Headlines & Market Impact

Pressure on China’s factories grows as U.S. demand falls

Notable Snippet: All the factories that U.S. toy maker Basic Fun works with in China — about 20 of them — told workers not to return immediately after the Lunar New Year holiday, said CEO Jay Foreman.

China’s exports to the U.S. in the toys, games and sports category account for about 6% of all exports to the country, according to China customs data accessed through Wind Information. That category of toy exports to the U.S. saw a slight drop in 2022, the data showed.

“Retail, anything consumer discretionary, they were hit quite hard. It was really a combination of high inventory and demand dropping quite a lot for the export markets,” said Johan Annell, partner at Asia Perspective, a consulting firm that works primarily with Northern European companies operating in East and Southeast Asia.

He said consumer electronics was seeing a similar situation.

When asked by CNBC in January, China’s customs administration acknowledged the pressure on China’s exports from slowing external demand, and noted rising risks of a global recession.

Trade data show demand for Chinese goods is going up in other markets, such as Southeast Asia.

What we think: The decline in demand for consumer electronics and toys is likely a result of reduced non-essential spending amongst the US consumer due to the inflationary pressures. However, the cheap alternatives from China still stand to gain rising demand from the global economy as supply chain issues ease out.

U.S. explores working with India to increase economic competition against China, says Commerce Secretary Gina Raimondo

Notable Snippet: Commerce Secretary Gina Raimondo said Wednesday that the U.S. is considering collaborating with India on certain manufacturing jobs in order to boost competition against China.

Raimondo told Jim Cramer on CNBC’s “Mad Money” that she will visit India in March with a handful of U.S. CEOs to discuss an alliance between the two nations on manufacturing semiconductor chips. The Commerce Secretary also revisited some of President Joe Biden’s comments on American manufacturing from his State of the Union address on Tuesday.

Raimondo said that India is “making a lot of the right moves.”

“It’s a large population. (A) lot of workers, skilled workers, English speakers, a democratic country, rule of law,” she said.

But the Commerce Secretary said the southeast Asian nation must comply with labour standards as part of any deal, especially in light of India’s consumption of Russian oil.

What we think: India is an emerging economy that stands to gain from the hostilities between the US and China. As the need to diversify the US’s supply chain grows, we believe India will receive even more investments into their economy from here.

Alphabet shares dive after Google AI chatbot Bard flubs answer in ad

Notable Snippet: Alphabet Inc (GOOGL.O) lost $100 billion in market value on Wednesday after its new chatbot shared inaccurate information in a promotional video and a company event failed to dazzle, feeding worries that the Google parent is losing ground to rival Microsoft Corp (MSFT.O).

Google has been on its heels after OpenAI, a startup Microsoft is backing with around $10 billion, introduced software in November that has wowed consumers and become a fixation in Silicon Valley circles for its surprisingly accurate and well-written answers to simple prompts.

"While Google has been a leader in AI innovation over the last several years, they seemed to have fallen asleep on implementing this technology into their search product," said Gil Luria, senior software analyst at D.A. Davidson. "Google has been scrambling over the last few weeks to catch up on Search and that caused the announcement yesterday (Tuesday) to be rushed and the embarrassing mess up of posting a wrong answer during their demo."

What we think: The Artificial Intelligence race continues and Google is facing the biggest risk to its Search business ever. The rise of AI will likely boost productivity in many areas in the months ahead.

Sentiment

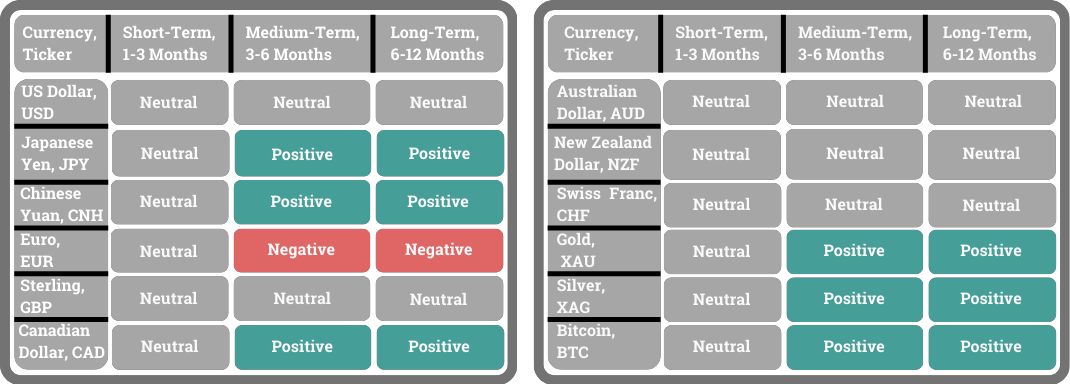

FX

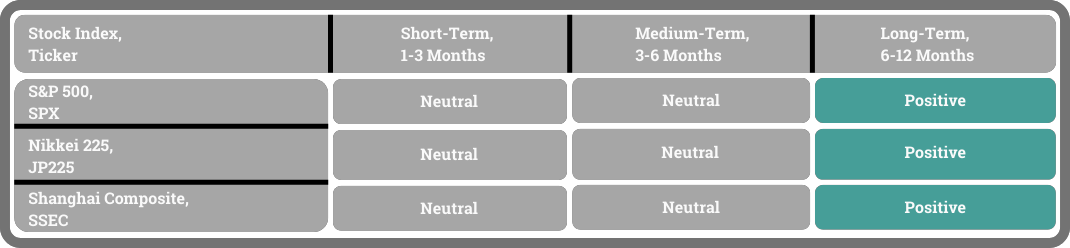

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord