What is the Fed thinking?

The market is likely to price for a slower pace of interest rate hikes in the meetings ahead.

For now, they are weighing the eventual need to cut the pace of interest rate hikes against the still elevated level of inflation. They are monitoring the effect of the previous aggressive rate hikes that tend to lag in showing their full impact on the economy,

Overall, the message is still that containing inflation remains a top priority, but they know that there is a danger of hiking too much, too soon if they keep hiking in big increments without waiting for the impact to be felt by the economy.

As such, if economic and inflation data should slow further, the market is likely to price for a slower pace of interest rate hikes in the meetings ahead.

Trading Tip

It is not only about that one trade

Many turn to the markets to seek fortune and turn their current capital into a windfall. For most of these people, they try to look for opportunities that will make them rich quickly. However, trades can sometimes take months and years to play out and multiplying your capital can almost never be done quickly.

As such, some start to park all their capital into a single trade or over leverage on them as a gamble to make a huge profit quickly. That is definitely not what trading is all about. The bedrock of being invested in the markets is risk management. By managing your risks properly, you will be able to cut your losses to survive the markets long enough to allow the good trades to roll in the multifold profits.

Day Ahead

Nothing noteworthy on the horizon today.

Trading Plan

1. Currencies:

EUR - Short the EUR. Stay patient.

2. Commodities:

Uranium & Energy - Stay invested.

3. Stocks:

US Stock Index: Stocks had a volatile trading day and ended in the red. However, the US Federal Reserve policy meeting minutes show that if economic data and inflation slows further, interest rate hikes will come at a slower pace. Buy on dips should continue to work.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: The US Federal Reserve officials’ comments on their thoughts on the fight against inflation will influence risk sentiment. The Ukraine-Russia war rages on, but the market impact is limited for now.

What Happened Yesterday

US Retail Sales showed a rise of 10.3% Year-on-Year (vs 8.1% expected). UK Consumer Price Index (CPI) showed a rise in prices of 10.1% Year-on-Year (vs 9.8% expected).

The Federal Reserve meeting minutes for July showed that the Fed remains resolute about bringing down inflation, but conceded that pace of rate hikes will eventually need to be slowed as tightening effects of previous interest rate hikes are lagging and will need to be monitored.

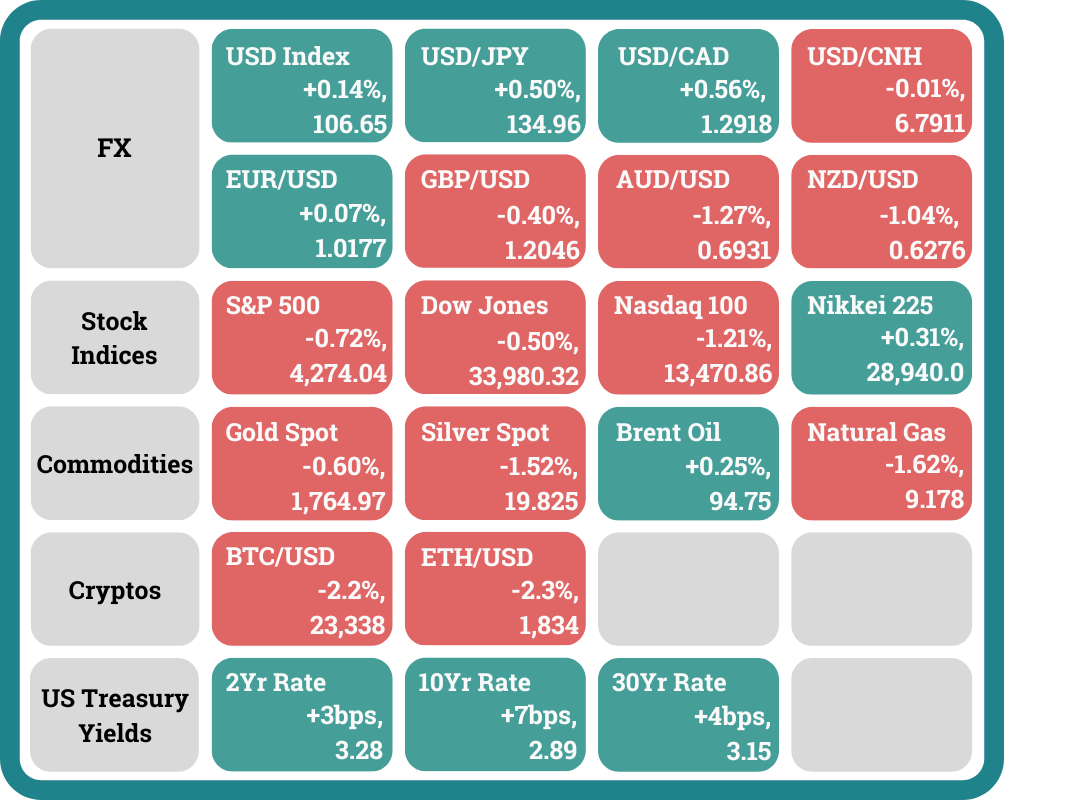

The US Treasury yield curve remains inverted with the difference in yields now at 0.39%. The 2-year US Treasury bond yield rose to a high of 3.38% in the early hours of US trading after the unexpectedly high UK inflation print. The slightly dovish Fed minutes caused the 2yr yield to ease off the highs and close +0.03% on the day at 3.28%. The 10-year bond yield rose to a high of 2.92% before closing +0.07% at 2.89%.

The US stock market had a volatile day, opening lower due to higher US yields, triggered by the bad UK inflation print. Stocks then bounced off the lows of -1.21% to reach a high of -0.07% from prev day close in the S&P 500 following the release of the Federal Reserve meeting minutes. The market then drifted lower towards the end of the day for the S&P 500 to close at -0.72%.. The Dow Jones (intraday low: -0.95%, intraday high: +0.03%) which fell -0.50% while the Nasdaq (intraday low: -1.80%, intraday high: -0.32%) dropped -1.21% on the day, went through similar swings.

The crypto market faced the same risk aversion experienced in the US stock markets. Bitcoin declined -2.2% and Ether fell -2.3%.

Headlines & Market Impact

Fed sees interest rate hikes continuing until inflation eases substantially, minutes show

Notable Snippet: Federal Reserve officials at their July meeting indicated they likely would not consider pulling back on interest rate hikes until inflation came down substantially, according to minutes from the session released Wednesday.

During a meeting in which the central bank approved a 0.75 percentage point rate hike, policymakers expressed resolve to bring down inflation that is running well above the Fed’s desired 2% level.

They did not provide specific guidance for future increases and said they would be watching data closely before making that decision. Market pricing is for a half-point rate hike at the September meeting, though that remains a close call.

Meeting participants noted that the 2.25%-2.50% range for the federal funds rate was around the “neutral” level that is neither supportive nor restrictive on activity. Some officials said a restrictive stance likely will be appropriate, indicating more rate hikes to come.

“With inflation remaining well above the Committee’s objective, participants judged that moving to a restrictive stance of policy was required to meet the Committee’s legislative mandate to promote maximum employment and price stability,” the minutes said.

What we think: This should not be surprising as the Federal Reserve has been vocal about their desire to bring down inflation to their 2% target and they will do it as long as data in the labour market allows them to do so.

Canadian lawmakers plan Taiwan trip amid rising China tensions

Notable Snippet: A delegation of Canadian lawmakers plans to visit Taiwan in October to seek economic opportunities in the Asia Pacific region, Liberal Member of Parliament Judy Sgro said on Wednesday, a move that could further stoke tensions between China and the West.

The relationship between China and the West has worsened since U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan earlier this month against Beijing's wishes. China claims Taiwan as its territory and is against foreign politicians visiting the island. Democratically governed Taiwan rejects China's claims.

What we think: With even Canada wanting to visit Taiwan to seek out economic opportunities in the region, China will definitely not back down. Expect tensions within the region to heighten even further.

Tencent, the $370 billion Chinese tech giant, posts first ever revenue decline

Notable Snippet: Tencent posted its first ever quarterly year-on-year revenue decline as stricter regulations around gaming in China and a resurgence of Covid-19 in the world’s second-largest economy hit the technology giant.

Tencent missed both revenue and profit forecasts. During the quarter, Tencent faced macroeconomic headwinds stemming from a resurgence of Covid in China and subsequent lockdowns of major cities, including the financial metropolis of Shanghai. Authorities have committed to a “Zero Covid” policy which has caused disruptions across the world’s second-largest economy.

“FinTech Services revenue growth was slower relative to prior quarters as COVID-19 resurgence temporarily impacted commercial payment activities in April and May,” Tencent said.

What we think: This goes to show the impact the zero-Covid policy had on China. More negative data should ensue.

Sentiment

FX

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord