What is US Treasury Secretary Yellen telling us?

This is not just a message about US policy, but she is also asking the rest of the world to follow suit.

This is not just a message about US policy, but she is also asking the rest of the world to follow suit.

Since her appointment, the message conveyed by Yellen has been consistent. Now is the time to take advantage of low borrowing costs to spend as much as is required to prevent the economy from scarring due to the pandemic.

This is not just a message about US policy, but she is also asking the rest of the world to follow suit. The US government is clearly bent on spending trillions of dollars to ensure that the US economy will be much stronger in the months ahead.

The mid-term elections are in 2 years, and the clock is ticking. The Democrats need to solidify their razor thin majority in the Senate and it’s always about the economy when it comes to elections.

You know the incentives, the outcomes are inevitable.

MARKET OBSERVATION

Uranium Getting Ready To Go Nuclear

The uranium industry was already in a particularly interesting chapter with both the world’s largest producer, Kazatomprom, and the world’s formerly second largest producer (that is because they are presently producing zero pounds from their two world class Canadian mines: McArthur River and Cigar Lake), Cameco, being forced to buy pounds in the spot market in order to deliver on their contractual commitments.

Uranium miners buying the physical commodity in the spot market with the expectation of higher prices in the future is something new in the sector and positive for prices. There wasn’t a time in history where uranium producers enter the market with such vigour with the intent of holding physical uranium.

The objectives articulated for these purchases were that the purchased Uranium would strengthen their balance sheets and enhance their ability to access future project financing, with the potential collateralization of the uranium holdings. These purchases removed pounds from what was perceived as an already tight spot market. You know what happens next.

DAY AHEAD

Canadian Jobs number could lead to renewed CAD strength should it surprise to the upside. The Canadian economy added an incredible 259.2k jobs in February and employment is forecast to have risen by another 90k in March. The Bank of Canada has already started taking steps to reduce its balance sheet by about C$100 billion and if the incoming data continue to surprise on the upside, it’s only a matter of time before further reductions in asset purchases are announced, underscoring the CAD’s relative appeal.

TRADING PLAN

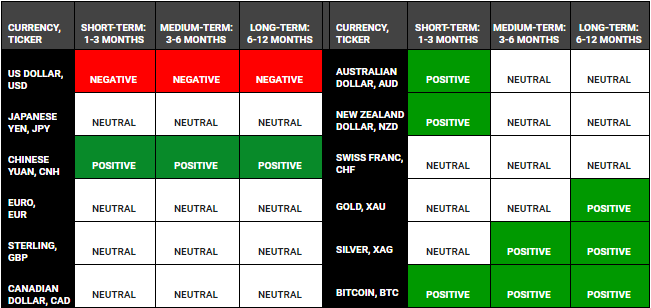

1. Currencies : Keep short USD and long NZD, & CNH. Stay patient.

2. Commodities : Silver — Neutral for now.

Key risks: Spikes in US bond yields may lead to a stronger USD and weaken risk sentiment. .

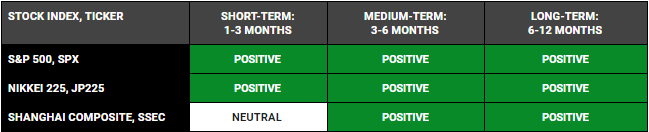

3. Equities :

Equity Index: : Long Nasdaq futures. Stay long.

Single Stocks: As expected, the market is starting the new quarter on a positive note, certain sectors which have been trending higher will resume their strong rallies. Don’t miss out on the asymmetric opportunities we have highlighted in our TrackRecord Model Portfolio.

Key risks : Higher US yields and inflation fears are the key risks.

WHAT HAPPENED YESTERDAY

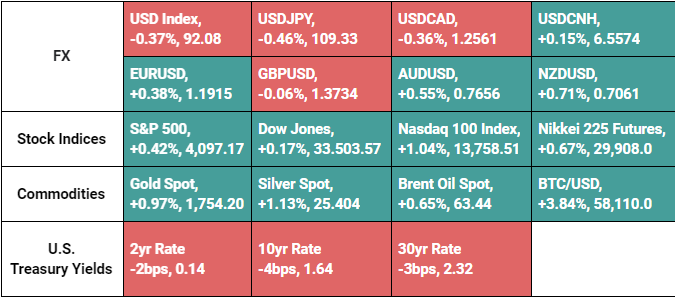

As of New York Close 8 Apr 2021,

MARKET MOVEMENTS

Fed Chair Powell spoke about the global economy in an event hosted by the IMF yesterday and signalled the central bank is nowhere near reducing its support for the U.S. economy, that while the economic reopening could result in a surge in prices, he expects it to be temporary and it will not constitute inflation. Powell’s comments reaffirmed the accommodative stance outlined in the minutes of the Fed’s policy meeting published on Wednesday. On a related note, weekly initial claims increased by 16,000 to 744,000 (expected 678,000), a warning sign that the jobs market still has a long way to go before full employment is achieved.

U.S. Treasuries traded stronger in a quiet session. The 2-yr yield decreased 2 basis points to 0.14%, and the 10-yr yield decreased 4 basis points to 1.64%. The U.S. Dollar Index fell -0.4% to 92.08. Dollar dipped to a two-week low against a basket of currencies on Thursday, tracking Treasury yields lower, after data showed a surprise rise in U.S. weekly jobless claims. WTI crude futures decreased -0.2% to $59.61/bbl.

S&P 500 increased +0.4% on Thursday, setting intraday and closing record highs in the process amid continued appreciation in the mega-caps and growth stocks. The Nasdaq (+1.0%) and Russell 2000 (+0.9%) outperformed the benchmark index, while the Dow Jones Industrial Average (+0.2%) underperformed.

Apple (AAPL 130.36, +2.46, +1.9%) and Microsoft (MSFT 253.25, +3.35, +1.3%) were some of the more influential gainers today on no specific catalysts, with Apple brushing off a report from the Nikkei that it’s delaying MacBook and iPad production due to the global semiconductor shortage.

HEADLINES & MARKET IMPACT

Yellen tells world’s big economies: spend big, danger lurks

Notable Snippet: U.S. Treasury Secretary Janet Yellen on Thursday warned of the risk of a permanent divergence in the global economy in the wake of the COVID-19 crisis, and urged major economies to inject significant new fiscal support to secure a robust recovery. In a statement to the steering committees of the International Monetary Fund and the World Bank, Yellen underscored the need for major economies to continue supporting developing countries as they grapple with the COVID-19 pandemic, climate change and high debt burdens. Yellen said Washington was implementing a $1.9 trillion COVID-19 relief plan and working on another large infrastructure package, urging other major economies to take similar actions. Yellen said developing countries should work with the IMF and World Bank on structural reforms and seek full-fledged IMF financing programs, which carry conditions, where necessary. Some countries may need deeper debt treatment, she added.

THEMATIC CONTEXT: “We believe there is more than meets the eye in this development as America embarks on the grandest monetary experiment in the form of Modern Monetary Theory (MMT). In the grand scheme of this experiment, taxes are not needed to pay for the deficit spending (because in MMT, a government with a sovereign printing press can issue as much fiat currency as it wants), it is instead a feature used to control the after effects of such money printing. There are predominantly two ways to quell inflation if it runs hot. 1. Raise Interest Rates, making Government Bonds more attractive so money gets sucked out of the private sector, 2. Raise Taxes. 1. is politically inexpedient given that no one is more short USDs and bag holders of USTs than the US government itself with current Debt/GDP of more than 100%. This leaves the US with choice number 2. when push comes to shove and higher taxes in the US alone will cause a brain and talent drain as companies will find more friendly pastures to set up. The conversation that Yellen is having with the rest of the world is showing that the US on a sovereign level is systematically fragile at the moment and the release valve will have to be a much weaker USD.” — 6th Apr 2021

Fed policymakers see risk from infections, not inflation

Notable Snippet: The U.S. Federal Reserve plans to keep its super-easy policy in place even as data shows the economy kicking into higher gear, with policymakers predicting on Thursday that an expected increase in prices this year will fade on its own, and warning about the recent uptick in COVID-19 infections.

THEMATIC CONTEXT: “We believe that our aforementioned comment is well en route to being realized and the focus on economic data recently is evidence of that. This is an important development as stronger data coupled with large fiscal policy is stoking inflation fears and putting upwards pressure on US rates which is inadvertently causing the weakness we are experiencing across most asset classes except for the Dollar. Faster and wider vaccine inoculation will exacerbate this phenomena and we should be looking to central banks to calm the markets if it gets worse . Once monetary policy measures are reassured to remain accommodative, we expect asset prices to rebound strongly and resume its uptrend.” — 26th Feb 2021

HSBC and Asian Development Bank join forces in $300 million vaccine financing

Notable Snippet: HSBC and the Asian Development Bank (ADB) will provide a combined $300 million in financing to help Asia’s supply chains boost manufacturing capacity for COVID-19 vaccines, the two lenders said on Friday. The initiative builds on a risk-sharing scheme the banks launched in July to help to fund suppliers of personal protective equipment (PPE) as they and vaccine makers race to meet global demand that outstrips supply.

THEMATIC CONTEXT: “Is America’s political posturing into an increasingly multipolar world too late? We believe that Biden touting American leadership again may lead to more cohesive policies and will be better for certain trade relations, but will not change the fact that the world is deeply entrenched into the splintering of economic factions that is fuelled by de-dollarization efforts. Any Dollar strength that arises from this should be sold into as the greenback is facing headwinds both domestically (record twin-deficits) and internationally (de-dollarization).” — 5th Feb 2021

SENTIMENT

FX

STOCK INDICES

Phan Vee Leung

CIO & Founder, TrackRecord