Stay invested and hold on to your hats.

The US stock market indices rose strongly (almost 2%) across the board yesterday on not much news. If you were listening to the talking heads or reading Financial Twitter, you would think it’s the end of the world with the US Producer Price Index rising 8.6% year-on-year, heralding the age of hyperinflation.

However, if you read our musings regularly, you will know that it is all about expectations. Market expected the number to be 8.7%, and with the market conditioned to having inflation metrics coming higher than expected, a surprise to the downside was good enough to add fuel to a rally that was triggered by strong earnings results by a number of key companies.

And so, the rise in risk assets is resuming in full force. Although the broad market is still far from the highs, quite a few of our picks in our Model Portfolio are breaking strongly to all-time-highs and are set to continue rampaging ahead.

Stay invested and hold on to your hats.

MARKET OBSERVATION

Bitcoin and cryptocurrencies adoption will continue unabated

Yes, we have heard of the possibility of Bitcoin ETFs sprouting out, giving pension funds and more retail investors the accessibility to trade the biggest and most famous cryptocurrency. However, cryptocurrencies are starting to proliferate into another industry that has not changed much in recent years — gambling.

Compared to traditional fiat currencies, cryptocurrencies are able to reduce the fees of fund transfers for casinos and provide a quicker way of collecting winnings for gamblers. This is a major boon for an industry that relies heavily on gratification. And there’s more, the usage of bitcoin (or cryptocurrencies in general) will allow gamblers to have more anonymity as a bank account or home address is no longer needed.

Decentralised apps and smart contracts continue to disrupt many parts of our lives in due time. Given that there are more industries that have not adopted the technologies brought about by cryptocurrencies and blockchain, the bullish case remains.

DAY AHEAD

US Retail Sales will be out today but should not move markets much unless there is a huge surprise to the downside.

TRADING PLAN

1. Currencies:

Keep short USD and long NZD, & CNH. USD is now on the backfoot against our preferred currencies. Stay short USD.

2. Commodities: Uranium & Energy — The rally continues. Stay invested.

Key risks: Higher US bond yields, and Fedspeakers’ thoughts on the tapering process

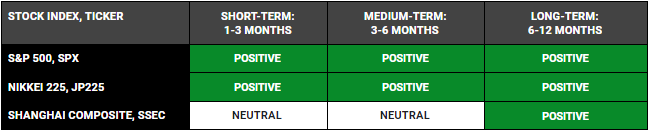

3. Equities:

Equity Index: Long Nasdaq futures. The rally is resuming, let’s go!

Single Stocks: Despite the broad market being lower in recent weeks, some of the stocks in TrackRecord Model Portfolio are making new all-time highs. Get involved and stay involved. `

Key risks : Higher US bond yields, and Fedspeakers on the tapering process in the days ahead

WHAT HAPPENED YESTERDAY

US Producer Price Index for September was a bit softer than expected. The index for final demand increased 0.5% month-over-month (expected +0.6%) and the index for final demand, less food and energy, increased 0.2% (expected +0.5%). On a year-over-year basis, the index for final demand was up 8.6%, versus 8.3% in August. That is the largest advance since the 12-month data were first calculated in November 2010. The Treasury market’s initial response is muted and indicative once again that market participants are sniffing peak inflation. The US 10-year Treasury note yield closed down 4 basis points at 1.52% (which is where it was just prior to the release).

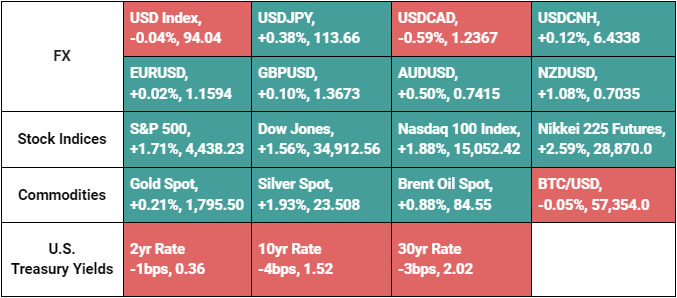

The U.S. Dollar Index remained relatively unchanged at 94.04.The dollar gained against the JPY but lost ground against the risk currencies (AUD, NZD) on a day where the stock markets were in full risk-on mode.

S&P 500 rallied +1.71% on Thursday, bolstered by positive earnings news, relatively encouraging economic data, and a decline in long-term interest rates. The Nasdaq (+1.88%) and Dow Jones Industrial Average (+1.56%) performed comparably to the benchmark index, while the Russell 2000 increased 1.4%.

The high-profile earnings winners included UnitedHealth (UNH 420.36, +16.81, +4.2%), Bank of America (BAC 45.07, +1.93, +4.5%), Morgan Stanley (MS 101.01, +2.44, +2.5%), Walgreens Boots Alliance (WBA 50.77, +3.51, +7.4%), Citigroup (C 70.80, +0.54, +0.8%), and Taiwan Semiconductors (TSM 112.56, +2.58, +2.4%).

TSM also provided upside Q4 revenue guidance, which served as an additional boost for the Philadelphia Semiconductor Index (+3.1%). Wells Fargo (WFC 45.31, -0.74, -1.6%) and U.S. Bancorp (USB 60.08, -1.38, -2.3%), however, struggled with losses despite beating expectations.

Separately, an FDA advisory committee unanimously recommended Moderna’s (MRNA 331.88, +10.38, +3.2%) booster shot for adults 65 years and older and other high-risk adults.

The U.S. Securities and Exchange Commission is said to not oppose the formation of Bitcoin futures ETFs as applications continue to stream in.

HEADLINES & MARKET IMPACT

U.S. FDA advisers back Moderna COVID booster shots for older and high-risk people

Notable Snippet: A panel of expert advisers to the U.S. Food and Drug Administration unanimously voted on Thursday to recommend booster shots of Moderna Inc’s (MRNA.O) COVID-19 vaccine for Americans aged 65 and older and those at high risk of severe illness or occupational exposure to the virus.

If the FDA signs off on Moderna’s booster, the U.S. Centers for Disease Control and Prevention will make specific recommendations on who should get the shots. CDC advisers are scheduled to meet next week.

COMMENTS/IMPACT: Once booster shot efficacy is proven, we believe this will lead to more economies reopening fully and put more pressure on the inflation front. As mentioned, we believe that absolute inflation will be much higher this decade and that commodities and equities will significantly outperform cash.

Biden signs bill raising U.S. debt limit, averting default

Notable Snippet: U.S. President Joe Biden on Thursday signed legislation temporarily raising the government’s borrowing limit to $28.9 trillion, pushing off the deadline for debt default only until December.

Without the increase in the debt ceiling, the U.S. Treasury had estimated it would run out of money to pay the nation’s bills on Oct. 18.

The $480 billion increase in the borrowing limit signed by Biden is expected to be exhausted by Dec. 3.

COMMENTS/IMPACT: Always, when push comes to shove, the US government or any government will do what they can to defend the last vestiges of the order. And this so happened to be the USD hegemony system. Unlimited money printing will still prevail.

Britain’s chicken king says the 20-year binge on cheap food is over

Notable Snippet: Britain’s 20-year binge on cheap food is coming to an end and food price inflation could hit double digits due to a tidal wave of soaring costs that are crashing through the supply chain, Britain’s biggest chicken producer said.

As it emerges from the twin crises of Brexit and COVID, the world’s fifth largest economy is facing an acute shortage of truckers, butchers and warehouse workers that has exacerbated global supply chain strains.

COMMENTS/IMPACT: We are moving from a decade of abundance to one of scarcity, the bubble is in fiat and knowing how to preserve one’s assets is an essential skill to come out on top in this new economic paradigm. We continue to be well positioned for such an outcome.

SENTIMENT

FX

STOCK INDICES

Phan Vee Leung

CIO & Founder, TrackRecord