Why is the stock market not lower?

This could be a sign that most of the investors who want to sell have already sold

After the recent spate of bad news on the inflation front, which showed that although price rises are moderating, they are still higher than what the market expects, the fear that the US Federal Reserve will continue to hike interest rate aggressively to a higher level and keep it at a high level for lower has increased.

This has resulted in the 2-year US bond yield rising to test 4.80%, close to the highs last seen late last year, when US stocks were close to the lows of this cycle. Now, however, US stocks (S&P500 and Nasdaq) are almost 15% higher than the lows they were trading at then.

Does this mean stocks have further to fall or it’s just that the market is now more used to living with higher interest rates and the fear of even higher interest rates? It is likely that market positioning has changed a lot since then and investors are a lot less invested than before.

The reaction from the disappointingly high inflation data (US PCE showing prices rose 5.4% year-on-year vs expected 5.0%) last Friday would have caused a bigger sell-off than the one we have seen so far (Nasdaq fell less than 0.6% over two days). This could be a sign that most of the investors who want to sell have already sold and if news does not get worse, the stock market is unlikely to test new lows in the days ahead.

Trading Tip

Surviving Market Mayhem

When things in the markets start to go awry, the moves in markets start to become larger as new information streaming in will start to trigger more random moves in the shorter term. During these periods, it is imperative that we adjust our trading accordingly in order to not get washed out by markets.

We should start to widen their stop loss to account for the massive spike in volatility as the moves get bigger. Should the position be too big for the stop loss, we can start to reduce the size of the position to suit the wider stop loss but still maintain the same amount of capital that we are risking on the trade. Once volatility starts to subside and if the trading view remains, we can scale back in gradually.

Day Ahead

Nothing noteworthy on the horizon today.

Trading Plan

1. Currencies:

CNH - Bullish. Still short USD/CNH but caution is warranted as we are approaching key resistance.

2. Commodities:

Uranium & Energy - Stay patient and stay invested.

3. Stocks:

US Stock Index: Stock markets performed surprisingly well in the early hours, hinting that positions may be heavily on the short side. However, Fed hawkish comments continue to weigh on risk sentiment.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: Fed officials’ comments on the future path of interest rates will influence risk sentiment.

What Happened Yesterday

Fedspeak:

Jefferson (current voter, known centrist): Lower inflation is a prerequisite for long-term prosperity. Right now the labour market is very strong with demand for workers high relative to supply.

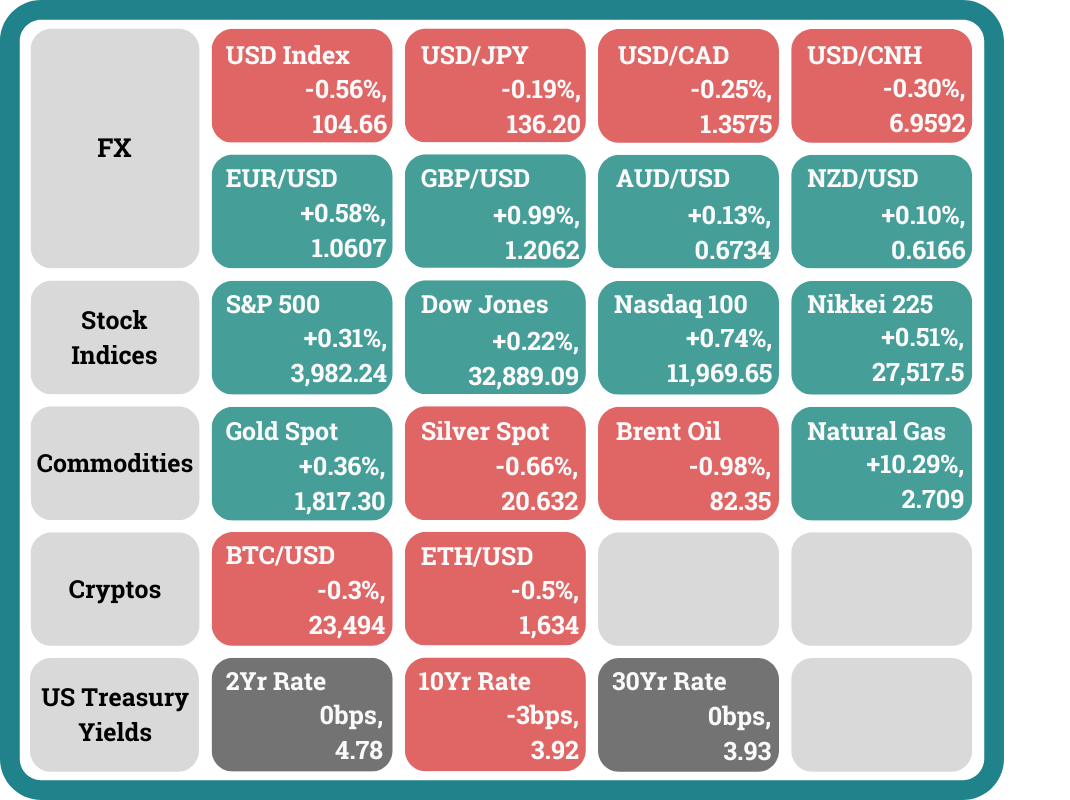

The US Treasury Yield curve inverted a bit more and the 2-year bond yield is now higher than the 10-year by 0.85%. The 2-year bond yield remained at 4.78% while the 10-year bond yield fell -0.03% to 3.92%.

The US stock futures attempted to bounce during early Asian hours with S&P 500 futures moving to a high of 3986 (+0.25%) before drifting lower back to the open of 3976. Another attempt to break higher was made as the London trading session approached, allowing the S&P 500 futures to reach a high of 4015 (+0.97%) just before the New York session started.

The US stock market opened higher on the day (the S&P 500 opened +0.56% compared to the previous close) and continued rising during the first hour of the NY trading session but it seemed like Fed’s Jefferson’s remarks on inflation and the weak risk sentiment from Friday took over and the market trimmed the gains. As a result, S&P 500 closed the day slightly higher +0.31% (intraday high: +1.21%, intraday low: +0.09%), the Dow Jones Index rose +0.22% (intraday high: +1.13%, intraday low: -0.01%) while the Nasdaq rose +0.74% (intraday high: +1.59%, intraday low: +0.54%).

The crypto market traded flat despite an attempt to break higher intraday (intraday highs - Bitcoin: +1.35%, Ether: +1.43%) as risk sentiment improved slightly. Bitcoin is down -0.3% while Ether slipped -0.5%.

Headlines & Market Impact

China must be 'more honest' on COVID-19 origins, envoy says

Notable Snippet: China must be more honest about the origins of the COVID-19 pandemic, the US ambassador to China said on Monday (Feb 27), after reports that the US Energy Department concluded the pandemic likely arose from a Chinese laboratory leak.

Nicholas Burns, speaking by video link at a US Chamber of Commerce event, said it was necessary to push China to take a more active role in the World Health Organization (WHO) if the UN health agency was to be strengthened.

China also needed to "be more honest about what happened three years ago in Wuhan with the origin of the COVID-19 crisis," Burns said, referring to the central Chinese city where the first human cases were reported in December 2019.

The department made its judgement with "low confidence" in a classified intelligence report recently provided to the White House and key members of Congress, the Journal said, citing people who had read the intelligence report.

What we think: 3 years on, the US is still going about the origin of the virus and pointing it towards China. With the balloon saga already straining relations, this act of blame certainly will not help matters.

China urges peace in Ukraine after US warns against aiding Russia

Notable Snippet: China said on Monday (Feb 27) it sought dialogue and a peaceful solution for Ukraine despite United States warnings that Beijing might be considering weapons supplies for its ally Russia's invasion.

China, which declared a "no limits" alliance with Russia shortly before the invasion a year ago, has refused to condemn the onslaught and last week published a 12-point plan calling for a ceasefire and gradual de-escalation by both sides.

China's foreign ministry said it had kept contact with all sides in the crisis including Kyiv and its position was clear.

"The core is to call for peace and promote dialogue and promote a political solution to the crisis," foreign ministry spokesperson Mao Ning told a news briefing in Beijing.

What we think: China’s role in calling for a ceasefire may be pivotal as its call for de-escalation is more receptive to Putin than any from the West. It will be important to monitor the situation because if China should succeed in brokering peace, risk sentiment will improve.

Mark Zuckerberg announces new team at Meta working on A.I. products for Instagram, WhatsApp

Notable Snippet: Meta will create a new product group inside the company focused on generative AI, a new set of machine learning techniques that allow computers to generate text, draw pictures, and create other media that resemble human output.

The move comes as big tech companies and well-capitalised startups alike race to tout advances in machine learning techniques and incorporate artificial intelligence models into their products.

The unit will combine several teams across Meta, CEO Mark Zuckerberg said in a Facebook post. The new group will be organised under current Chief Product Officer Chris Cox.

“We’re exploring experiences with text (like chat in WhatsApp and Messenger), with images (like creative Instagram filters and ad formats), and with video and multi-modal experiences,” Zuckerberg said. “We have a lot of foundational work to do before getting to the really futuristic experiences, but I’m excited about all of the new things we’ll build along the way.”

What we think: The jump on to the Artificial Intelligence bandwagon continues. As AI usage continues to broaden, productivity will increase in many areas.

Sentiment

FX

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord