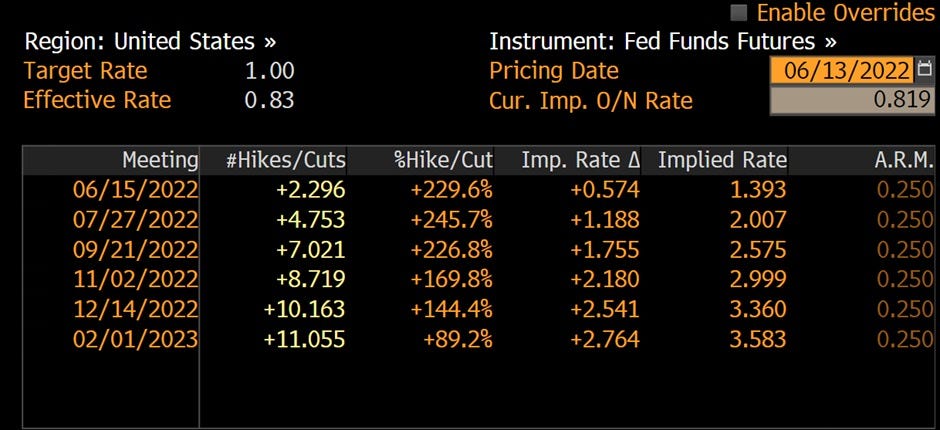

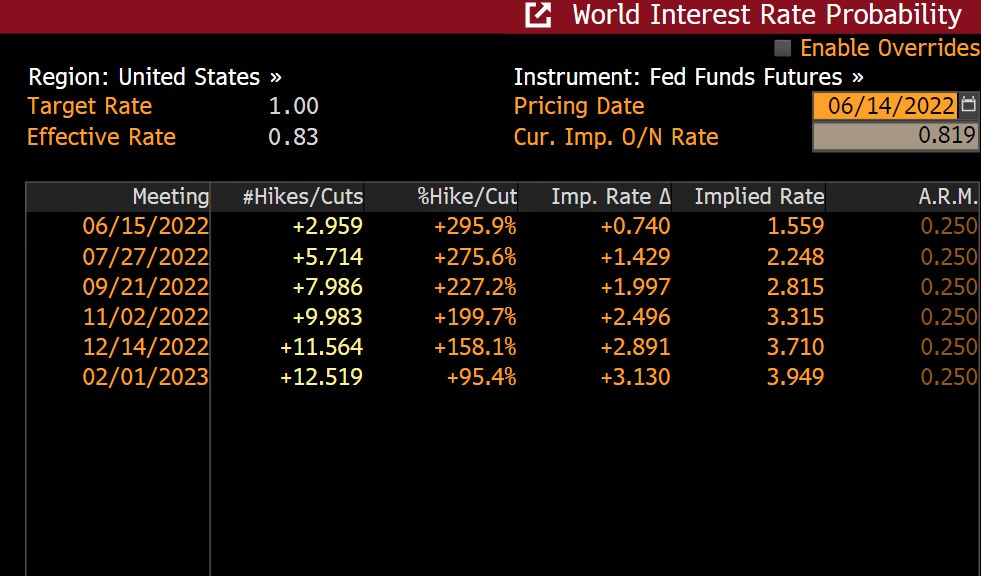

After Friday’s spike in US bond yields, the market continued with the panic selling of bonds as investors start to price in the probability of a 0.75% hike in the meeting tomorrow. The spike in US bond yields led to selling of risk assets across the board and a stronger USD.

For now, everything hinges on what the US Federal Reserve does and says in their policy meeting tomorrow. What is certain is that market moves will be wild. Tread carefully!

Source: Bloomberg

Trading Tip

Fear begets fear

In times of uncertainty when fear is taking hold of markets such as now, one thing is for sure: volatility will remain high. Once markets are in the grips of fear, any headline no matter how minute or insignificant can cause market participants to panic and sell their risk assets.

Hence, that is why it is imperative to size your trades appropriately (i.e. trade size should be smaller than during normal market conditions) and widen your stops during such times as we will see wider movement across all asset classes.

Day Ahead

Today’s US Producer Price Index should continue to show new highs in tandem with last Friday’s Consumer Price Index.

Trading Plan

1. Currencies:

EUR - Short the EUR. Stay patient.

Key resistance/support levels -

Resistance is at 1.0770-80. Support is at 1.0340-50

2. Commodities:

Uranium & Energy - Stay invested.

3. Stocks:

US Stock Index: Stocks continue to sell-off as fear of more aggressive interest rate hikes from the US Federal Reserve ratcheted higher.

Single Stocks: TrackRecord Model Portfolio is tracking the broader market for now.

Key risks: The US Federal Reserve’s policy meeting this week is the key driver of markets for now. The Ukraine-Russia war rages on, but the market impact is limited for now.

What Happened Yesterday

US Treasury yields made an even bigger spike in yesterday’s trading session following reports that the Fed may hike +0.75% in tomorrow’s meeting. The US 2yr Treasury Yields soared +0.34% to 3.40%, reaching levels last seen in 2007 while the 10yr Yields rose +0.28%. The 2yr yields rose above the 10yr yields momentarily in yesterday’s session resulting in an inversion which usually signals an impending recession.

The US stock market officially entered bear market territory as the S&P 500 closed 21% below the all time record high seen in January at the beginning of this year. The major indices saw a rapid plunge in prices as news that a 0.75% rate hike will be considered by the Fed in tomorrow’s policy meeting hit the wires. The S&P 500 plunged -3.88%, the Dow Jones declined -2.79% while the Nasdaq saw a massive drop of -4.60%.

The crypto market suffered from a massive selloff as the world’s largest crypto exchange, Binance, had a temporary pause in withdrawal just half a day after lending platform, Celsius, had theirs. Bitcoin collapsed -15.6% and Ether plunged -16.0% yesterday and prices are continuing to fall as of this morning.

Headlines & Market Impact

Morgan Stanley CEO James Gorman sees 50-50 odds of recession ahead

Notable Snippet: “It’s possible we go into recession, obviously, probably 50-50 odds now,” Gorman said Monday at a financial conference held by his New York-based bank. That’s up from his earlier 30% recession-risk estimate, said Gorman, who added that “we’re unlikely at this stage to go into a deep or long recession.”

Gorman was speaking as markets were in freefall amid expectations that central banks need to aggressively combat inflation. Bank executives have raised alarms about the economy recently as the Fed raises rates and reverses quantitative easing programs. Rival CEO Jamie Dimon said he predicted a “hurricane” ahead due to central banks and the Ukraine conflict.

While markets have been crashing, the fundamentals of the economy, including consumer and corporate balance sheets, are in better shape than markets suggest, which gives Gorman comfort, he said.

Still, the Fed waited too long to raise rates, which gives them less room to manoeuvre should a recession begin, Gorman said. The CEO began discussing the risk of a recession with his internal committees last August or September when it was clear that inflation was going to be more persistent than hoped, he said.

What we think: With more and more CEOs coming on the wires talking about an impending recession, a self-fulfilling prophecy will ensue and we should see a contraction in the labour market as well. Additionally, the recovery from this recession will take a while due to the ongoing issues and limited playbook of policymakers.

Binance paused bitcoin withdrawals for several hours Monday due to a ‘stuck transaction’

Notable Snippet: Binance on Monday morning temporarily paused bitcoin withdrawals “due to a stuck transaction causing a backlog.”

A tweet from Binance founder and CEO Changpeng Zhao noting the issue came at 8 a.m. ET, at which point Zhao said the problem would be resolved in around 30 minutes. He later said it would take “a bit longer to fix than [his] initial estimate.”

Binance said in a tweet at 11:32 a.m. on Wall Street that bitcoin withdrawals had resumed.

“Funds are SAFU,” he added. The acronym stands for “secure asset fund for users,” which is a fund the company established in 2018 to help safeguard users.

“A batch of $BTC transactions got stuck due to low TX fees, resulting in a backlog of BTC network withdrawals,” Binance said in a tweet.

What we think: At this point where market volatility is starting to spike, any headline can start to trigger massive selloffs in most asset classes. It is imperative that we size our trades small enough to tide through this period. (SAFU just means safe, much like HODL is hold in cryptospeak)

Fed likely to boost interest rates by three-quarters of a point this week

Notable Snippet: Markets are beginning to anticipate an even faster pace of interest rate hikes, and Federal Reserve officials apparently are contemplating the possibility as well.

Central bank policymakers are entertaining the idea of a 75 basis point increase to the Fed’s benchmark funds rate that banks charge each other for overnight financing, according to CNBC’s Steve Liesman.

Changes in the economic outlook, including the likelihood that inflation hasn’t peaked and is running well ahead of the Fed’s 2% goal, could influence a bigger rate move during the two-day meeting that concludes Wednesday.

A 75 basis point move is “a real distinct possibility,” Liesman said.

What we think: Although the Federal Reserve has been telegraphing their actions ahead for a 0.50% hike in the next 2 meetings, the spike in the inflation data last Friday has spooked the market. Many sell-side analysts and “insiders” are scrambling to revise their calls to hikes of 0.75% instead. Although there’s likely to be little value in panic hiking, the Fed is on its backfoot, and may indeed act aggressively in trying to claim back its credibility.

Sentiment

FX

Stock Indices

Best,

Phan Vee Leung

CIO & Founder, TrackRecord